15 Best Personal Finance Software for Managing Your Money in 2025

Managing money is no longer about piles of receipts or endless spreadsheets. Today, personal finance software makes it simple to track expenses, set budgets, and plan for the future—all from your phone or computer. This market is expanding rapidly, valued at $1.39 billion in 2024 and expected to reach $1.48 billion in 2025, with projections of $2.39 billion by 2033.

Even the broader personal finance app industry is set to grow from $17.75 billion in 2024 to $21.4 billion in 2025, showing that people everywhere are turning to tech to take control of their money. In this article, we’ll look at the top 15 best tools to help you manage your finances more effectively.

Why Use Personal Finance Software

- Saves Time with Automation – Most tools can link directly to your bank accounts, credit cards, and investment portfolios, pulling in transactions automatically so you don’t have to spend hours updating spreadsheets manually.

- Keeps Finances Organized – You can view income, expenses, bills, debts, and savings goals all in one dashboard, making it easier to spot trends and track progress without juggling multiple apps.

- Improves Spending Habits – By categorizing expenses and showing you exactly where your money goes, these tools highlight wasteful spending and encourage more mindful purchasing decisions.

- Reduces Financial Stress – A clear view of your current and future finances helps you avoid last-minute scrambles for bill payments, reduces anxiety, and allows for better decision-making.

- Helps Reach Long-Term Goals – Whether it’s building an emergency fund, saving for a home, or retiring early, personal finance software lets you set milestones, track progress, and adjust your plan as life changes.

How to Choose the Right Tool for You

- Define Your Financial Priorities – Are you looking for simple expense tracking, debt payoff planning, investment monitoring, or a combination of all three? Knowing your priorities will narrow your choices quickly.

- Check Platform and Device Support – Some tools work best on desktop, while others shine on mobile. If you work across devices, look for software that syncs seamlessly between phone, tablet, and computer.

- Compare Pricing and Value – Many apps have a free version with basic features, while premium tiers offer automation, advanced reporting, and goal tracking. Weigh the cost against the features you’ll actually use.

- Evaluate Security and Privacy Measures – Choose software that uses bank-level encryption, two-factor authentication, and clear privacy policies to protect your sensitive financial data.

- Research User Reviews and Try Free Trials – Before committing, read reviews from real users to understand the pros and cons, and take advantage of trial periods to see if the interface feels intuitive to you.

List of Personal Finance Software

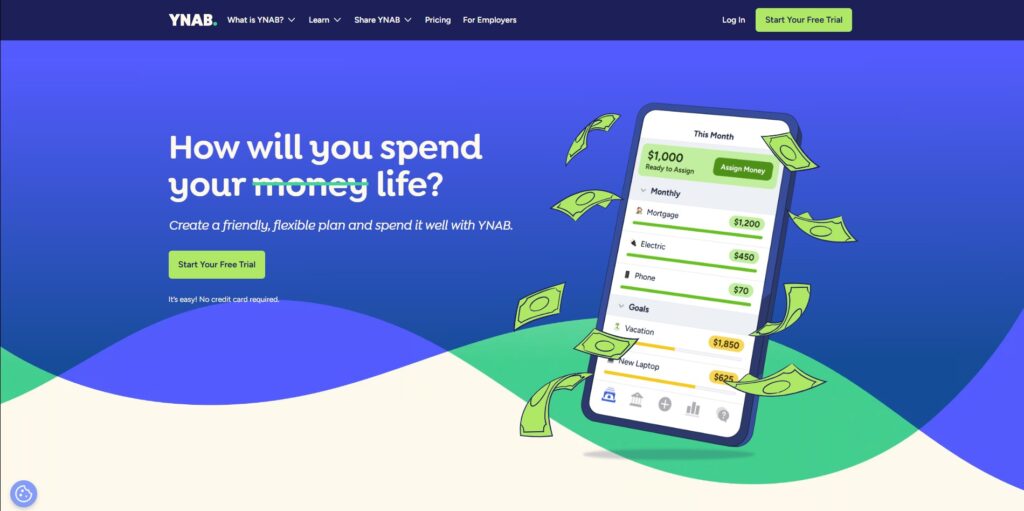

1. You Need a Budget (YNAB)

YNAB is an aggressive budgeting app with a very good philosophy of zero based budget system: each dollar you earn is put to a purpose. The practical aspect of this tool promotes discipline by requiring the user to make his or her financial decisions beforehand. The learning curve enjoys plentiful educational materials and an active community- with practical applications being used in the very discussions over at Reddit on the subject of budgeting tools.

YNAB links to many accounts, but does not require syncing which is convenient to some privacy-conscious users. It has a free trial of 34 days and the prices are approximately 14.99/month or 109/year and college students can get a free year.

Top Features:

- Zero-based budgeting with clear goal-setting

- Account syncing (with optional manual mode)

- Educational content and workshops

- Collaboration via “YNAB Together” feature

Pricing:

| Monthly Plan | Annual Plan |

| $14.99/mo | $9.08/mo |

2. Monarch Money

Monarch Money is a sophisticated, sleek budgeting software that has powerful functionality to enable full financial oversight. Bank accounts, credit cards, loans, and investments can be synchronised in one place by users. It provides both detailed category budgeting, and simplified 3-bucket fixed, non-monthly, and flexible budgets known as flex budgeting. Monarch also follows the net worth, displays investment dashboards, custom reports, and reminds about the coming bills.

Such a one-stop operation has a premium tariff of about 99.99 $/year which has a short trial time. Saying that, you can even add a member to the household without paying any additional costs. It is excellent when it comes to money sharing. Although rated as high, others can be neglected by the cost of using the tool, especially those people who are looking at simple and less expensive tools.

Top Features:

- Multi-account syncing (banking, loans, investments)

- Dual budgeting styles: flex and category

- Net worth and investment tracking

- Household member access included

Pricing:

| Monthly | Yearly |

| $14.99/mo | $8.33/mo |

3. Moneyspire

Moneyspire is a personal finance program available on multiple platforms that creates a cross-platform desktop and mobile personal finance software with an emphasis on versatility and user control. It is available on Windows, macOS, Linux, and Chromebook, with iOS and Android companion apps. The financial manager Moneyspire allows you to manage accounts, bills, loans, budgets and investments as well as have the Pro features of invoice creation, multiple currencies and importing transactions using csv, ofx, qfx and qbo.

Among the most remarkable pros is the fact that it does not push you online, and your data can be kept local which will provide you with privacy and flexibility. One can easily sync their data between their devices since the desktop versions are synced, and the software is easily customizable, and there is solid support. Before making the purchase, there is a free trial.

Top Features:

- Cross-platform compatibility + mobile companion app

- Bill, budget, loan, and investment tracking

- Full import support (QIF, OFX, CSV, etc.)

- Offline-first with optional cloud syncing

Pricing:

- $59.99

Suggested Read: Emergency Loan Apps in India

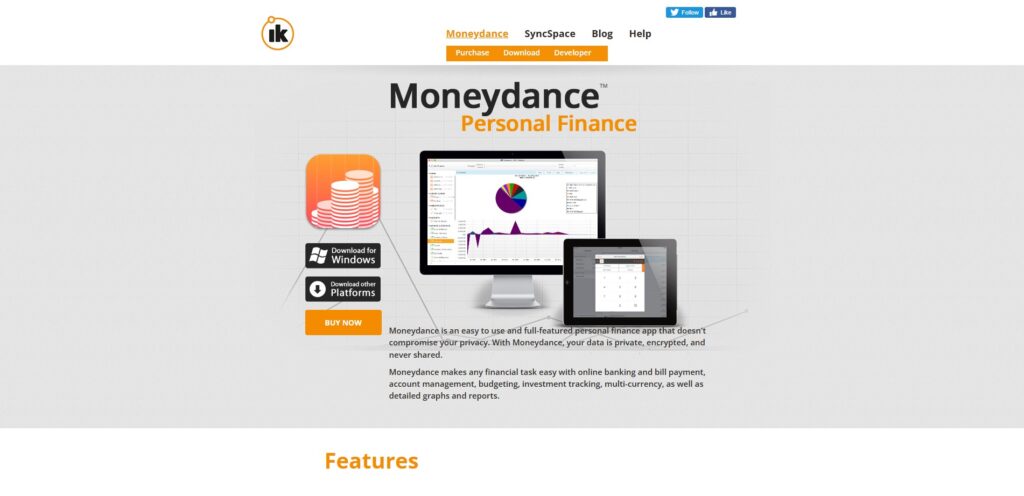

4. Moneydance

Moneydance is an older but Java-based personal finance application that can be used on most operating systems–it runs on Linux, macOS, and WindowsThis legacy can be attributed to its traditional balance books style with an interface that is friendly to the general user, although it is dated (first release in 1997) There is online banking through OFX, bill payment, graphing and reporting, scheduled transaction reminders, tagging, VAT/GST, encryption and portfolios of investments.

It also offers an extension API and can be scripted using Jython by advanced users who would like to create custom workflows. Due to its powerful architecture and extensibility it has a following with tech-savvy people who moved easily into the desktop tools.

Top Features:

- Cross-platform Java application

- Double-entry bookkeeping system

- Online banking and bill payment (OFX)

- Scripting and extension support (API, Jython)

Pricing:

- $67.35

5. GnuCash

GnuCash is an open source, free of charge, and double entry accounting program that is right at home with someone requiring transparency along with flexibility. It is a personal and small-business finance application, supports Linux, macOS, Windows, and other Unix-like systems. It has the ability to track accounts and transactions, to schedule, budget, report, script using Scheme and generate specialized reports.

Top Features:

- Double-entry bookkeeping engine

- Multi-platform and open-source GPL license

- Custom scripting and reporting (Scheme)

- Robust budgeting and scheduling tools

Pricing:

- Free

6. Quicken

Quicken has a long track record as a personal finance software heavyweight, which in some circles has long been considered the most complete all-in-one-package, especially when both consumer desktop and mobile access is needed. It is compatible with windows, macOS, iOS and Android, and can import as well as connect with QIF and OFX files which means that the programs can sync files relatively easily. It has a powerful desktop platform that provides the foundation when it comes to complex financial monitoring and its use of cloud storage and synchronisation guarantees easy usage across computer platforms.

It is a powerful one, but Quicken has a comparatively high price to the simpler ones. It can be overwhelming even to a beginner or anyone who wants simple card budgeting apps. And it has the advantage of being so well known and having such a long history that it provides obvious user knowledge, tutorials, and community support.

Top Features:

- Desktop-plus-app ecosystem across major platforms

- Rich budgeting tools and bill payment integration

- Investment and portfolio tracking

- Import from QIF/OFX formats + cloud backup

Pricing:

- $2.99/mo

7. Buxfer

Buxfer is highly recommended money management software with useful tools that can be used by individual people and small groups of people who are interested in an all-in-one personal finance software. It promotes ride on tracking of expenses, budgets, forecasts, and tracking of investments within a very clean user-friendly environment. Multi-currency support is one of its major strengths and it is suitable to use by users that are used to earn, spend or invest in various currencies. The platform also provides expense sharing for groups, ideal in the case of roommates, families, or travel companions who have to share their expenses in the most effective way conceivable.

Buxfer pays a lot of attention to the future planning. Its budgetary components can be based on your past earnings and expenditures to determine what future costs and cash flow patterns are likely. It is possible to form several budgets, define own savings targets, and receive notifications about bills. Buxfer offers highly secure features, such as bank-level encryption and 2FA which promises your security and at the same time gives you control to access your information wherever they are.

Top Features:

- Multi-currency support for global transactions

- Financial forecasting and long-term planning tools

- Group expense tracking and bill splitting

- Customizable budgets and savings goals

- Secure access with encryption and two-factor authentication

Pricing:

| Plus | Pro | Prime |

| $7.99/mo | $9.99/mo | $20.99/mo |

8. Empower

Empower blends investment-grade wealth management with essential budget-tracking tools. It helps users visualize investments, monitor expenses, and understand their overall financial health from one central place.

What’s more—Empower is completely free, making it accessible to anyone needing combined budgeting and investment oversight. Its robust tracking and interactive visuals bridge the gap between simple expense tracking apps and more complex financial tools. For users whose finances go beyond the basics—maybe involving investment accounts or retirement portfolios—Empower offers valuable insight without a price tag.

Top Features:

- Free net worth and wealth tracking tool

- Aggregates diverse accounts (checking through investment)

- Spending snapshots with customizable categories

- Intuitive dashboard with multi-platform access

Pricing:

- Free

9. Axio

Axio, formerly known as Walnut, is a personal finance app designed for effortless expense tracking and smart money management, especially for Indian users. It automatically scans your SMS notifications from banks, credit cards, and payment wallets to track expenses without requiring you to manually enter each transaction. The app organizes spending into categories, helping you understand where your money is going and allowing you to set better budgets. Axio also sends timely bill reminders so you never miss a due date, making it a practical everyday finance companion.

Beyond budgeting, Axio offers tools to manage credit and loans, track bank balances across multiple accounts, and monitor spending trends over time. The app’s clean dashboard provides a consolidated view of all your finances in one place, making it easy to spot unusual activity or overspending. With strong privacy protections, Axio ensures that your SMS and financial data stay secure and private, while giving you full control over permissions and data usage.

Top Features:

- Automatic expense tracking via SMS alerts

- Bill reminders and due date notifications

- Multi-bank and multi-wallet account support

- Spending categorization and trend analysis

- Strong privacy and security controls

Pricing:

- Free

10. Goodbudget

Goodbudget restores the old-school practice of envelope budgeting, with a digital twist. It does not use your bank account information to pull data, but works entirely on manually entered balance information and expense entries into virtual envelopes that are spending categories. Although the free version limits the amount of envelopes and devices, it is free and gives a practical and realistic budgeting process.

Another option, Premium, will allow unlimited envelopes and account access as well as devices. It is particularly applicable to the customers that like structure and clear organization of envelope budgeting and want to do their tracking manually and not through automation. Educational information is also useful and informs the user on how to conduct proper financial planning.

Top Features:

- Envelope-style budgeting (category-based planning)

- Manual entry for focused control

- Free tier available; Premium for more flexibility

- Educational articles and resources

Pricing:

| Free | Premium |

| $0 | $10/mo |

11. EveryDollar

EveryDollar is a zero-based budgeting app by Ramsey Solutions, based on the zero-based budgeting strategy popular on its own site. The tool concentrates on ensuring that every dollar gets a job so that all the Passive Income is spent in expenses, savings, or pay off debts. This approach can also align with effective long-term revenue plans, helping users sustain financial growth over time. The free version will only allow manual entry of expenses whereas the premium version will provide auto syncing to bank accounts, automatic tracking of transactions, and customizable reports that will give greater insight. It is very effective as its clean design and goal-tracking attitude to budgeting can work wonders to those who take debt payoff and discipline in savings seriously.

Another notable aspect is how the service fits into the network of the Ramsey+ platform, which allows access to educational materials, online courses, and mentoring by professional coaches. Although it is not a free or the cheapest alternative, it still targets the audience that needs the structured guidance and motivation they can get along with their budgeting tool. In case you are already on the Baby Steps plan proposed by Dave Ramsey, EveryDollar fits this money philosophy perfectly.

Top Features:

- Zero-based budgeting structure

- Manual or automatic transaction tracking (premium)

- Goal-oriented budgeting tied to the Baby Steps

- Integration with Ramsey+ resources

Pricing:

| Free | Premium |

| $0 | $17.99/mo |

12. CountAbout

CountAbout is a budgeting multi-platform cloud application that boasts an easy transfer of your data out of Quicken or Mint making it an excellent solution for those who want to migrate platforms without losing their history. It will automatically synchronize with thousands of financial institutions to keep your budget current even though it still stills allows in-depth manual adjustments. CountAbout is in-browser and has iOS & Android apps.

Its customization capabilities are also excellent- one can assign an unlimited number of categories, label transactions and a clear recurring transactions set up. Although its interface is straightforward, it is highly practical, so it would be the preferred choice by the user who does not want any fancy features and needs a safe budgeting tool. There are subscription plans that begin at a low cost and because it is on cloud no desktop software needs to be downloaded.

Top Features:

- Easy migration from Quicken or Mint

- Automatic syncing with banks and credit cards

- Unlimited category and tag customization

- Web-based with mobile app access

Pricing:

| Standard | Premium |

| $9.99/mo | $39.99/mo |

13. Monefy

Moneyfy is a lightweight but effective personal finance app that is targeted to the users, who do not necessarily need to dive deep into the unknown but wish to have a quick and convenient way to track their spending without having to use complicated functions. It enables you to record transactions with a few taps and categorize them and automatically receive insight into your spending behaviors. The application will help one to manage several currencies, repeating spending, and customized categories that contribute to its high flexibility in terms of budgeting at a personal and family level. It has a simple and less busy interface that makes you attentive to what is more important knowing where your money is spent.

One of the main benefits of Monefy is that it works offline. If you value your privacy, you do not have to connect your bank accounts since you can enter the expenses manually and synchronise them with your devices via Google Drive or Dropbox. Monefy has clear charts, maximum budget limits and widgets which can be customized as well, and can be used when on the move. It’s easy to use, not heavy and ideal for the person who has issues with cluttered products.

Top Features:

- Quick expense entry with a few taps

- Multiple currency and category support

- Offline tracking with cloud backup options

- Budget limits and spending reports

- Cross-device synchronization via Google Drive or Dropbox

Pricing:

- Available on request

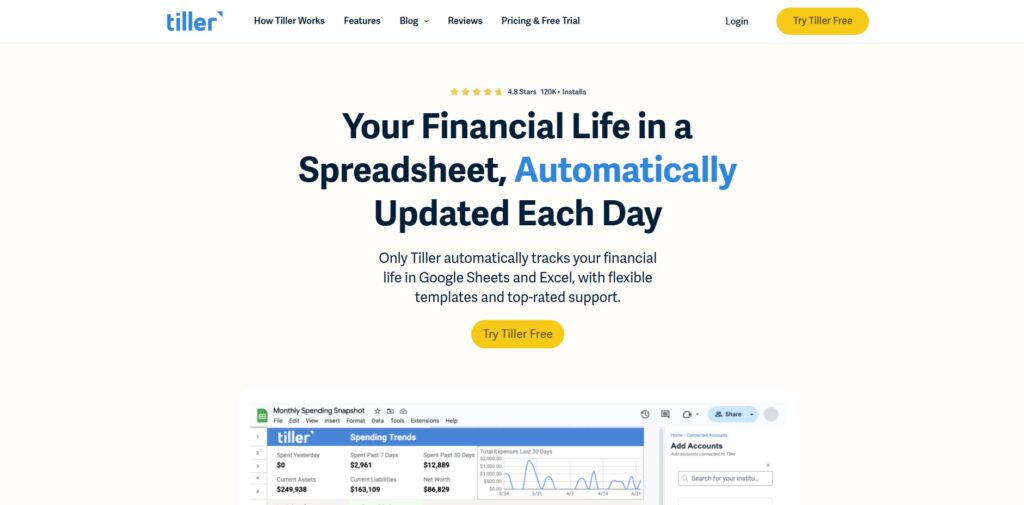

14. Tiller Money

Tiller Money is an alternative solution that uses Google Sheets or Excel as a completely automated financial dashboard. It automatically imports your transactions into your bank accounts and sets them into customizable spreadsheets. Such versatility enables you to construct your own budgeting, debt repayment or net worth monitoring scheme without being tied to a specific format of an app.

It is a subscription at a fee of 79/year which comes with templates, auto-update daily, and customer support. Tiller is heaven on earth to those who like to be in control and see what goes on in their spreadsheet. Because the data exists in your own spreadsheet, you can clean or alter it, add charts, or permit it to connect with other software–to create it as simple or complex as it needs to be.

Top Features:

- Automatic bank feeds into Google Sheets or Excel

- Fully customizable templates and categories

- Daily transaction updates

- Powerful for spreadsheet power-users

Pricing:

- $79/yr

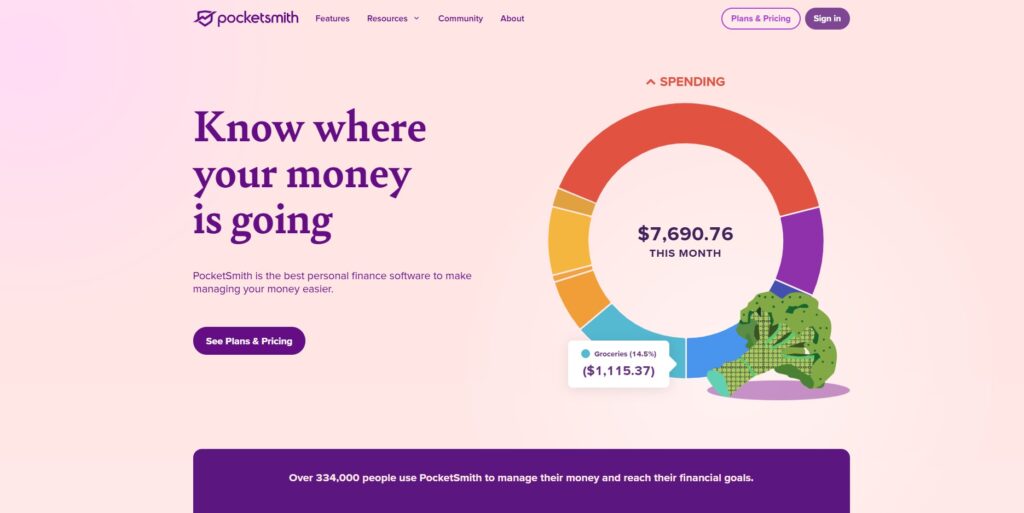

15. PocketSmith

PocketSmith is a forward-looking budgeting tool with cash flow forecasting at its core. It lets users project their finances days, months, or even decades into the future—helping visualize the long-term impact of current spending habits. The calendar-based interface makes it easy to see upcoming bills, expenses, and balances at a glance.

It supports multi-currency accounts, automatic bank feeds (in paid plans), and flexible budgeting methods. PocketSmith is particularly appealing to planners and long-term goal-setters who want to see the big picture.

Top Features:

- Long-term cash flow forecasting (up to 30 years)

- Calendar-based financial planning

- Multi-currency and account support

- Flexible pricing plans

Pricing:

| Foundation | Flourish | Fortune |

| $9.99/mo | $16.66/mo | $26.66/mo |

Conclusion

In conclusion, managing your money doesn’t have to be complicated or stressful. You can remain on top of your bills, plan for both immediate needs and long-term goals, and keep track of every rupee or dollar with the correct personal finance software. You may make better financial decisions, save time, and gain clarity with the aid of these tools. There is a solution out there that suits your preferences and objectives, regardless of how experienced you are with budgeting or whether you want more sophisticated tracking. Selecting one that best suits your needs, sticking with it, and using technology to simplify your financial life are the keys.

FAQs

Is free personal finance software good enough?

Free versions can work well for basic needs like expense tracking and budgeting. However, premium versions often include advanced features like automation, detailed reporting, and investment tracking.

How safe is my financial data with these tools?

Reputable software uses bank-level encryption, secure servers, and privacy protocols to protect your information. Always check a tool’s security policy before signing up.

Can personal finance software help with saving money?

By showing where your money is going, highlighting unnecessary expenses, and letting you set savings goals, these tools can help you put more aside each month.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!