Top 10 Financial Management Tools for 2026

Money management may be daunting. Bills are stacked up, the costs appear to be interminable, and you struggle to keep on top of it all day by day. This is where financial tools come to your rescue. These financial assistants will simplify, make it clear, and make it easy to control money.

Financial tools can change your approach to money, whether you are a student wishing to save for college, a family wishing to save for the future, or a business owner who has to deal with a myriad of bills. They make difficult numbers easy to understand so that you can tell where your money goes and how to work it to better benefit you.

In the modern world, it is impossible to manage finances without the help of appropriate tools, just as the city cannot be navigated without a map. You may arrive at your destination someday, but you waste time and energy, and you are likely to waste money in the process. Financial management tools are your financial compass, and they will lead you to better financial decisions and financial prosperity.

What are Financial Management Tools?

Financial management AI tools are computer applications that can guide you on how to monitor, organize, and manage your money. Consider them like your own financial consultant, who does not sleep. Such tools are capable of tracking your expenses, budgeting, investing, auto payment of bills, and even saving money. There are numerous types of these tools. Others are mere applications that you have on your phone and that record your everyday costs. Others are multifaceted computer programs capable of handling business finances in their entirety. Others are free, and others are paid money, yet are more advanced in their features.

The beauty of financial management tools is seen in the fact that they make complicated financial tasks easier. You will no longer have to spend hours with calculators and spreadsheets to get insights into your financial health; all you need is a couple of clicks.

Why Look for Financial Management Tools?

- Better Money Control: The financial management tools also provide you with full access to spending your money, a nd you can see where exactly all your money goes.

- Time Saving: Automated recording and bill payments save hours that would be spent on manual financial assignments.

- Reduced Financial Stress: It is easy to see financial images and structured information, which results in the absence of panic over money uncertainty.

- Better Financial Solution: Live data and trends in spending will assist you in making wise decisions regarding your money.

- Goal Achievement: Inbuilt savings plans and tracking of progress will ensure that you are encouraged to achieve your financial goals much earlier.

Top 10 Financial Management Tools

1. Mint

Mint is one of the most popular free financial management tools available today. Mint is a free service created by Intuit, the developer of TurboTax and QuickBooks. It is linked with more than 20,000 financial institutions, whereby transactions are automatically classified and real-time information on your financial status can be viewed. The site is also skilled in budget making, tracking of bills, and monitoring of credit scores. Mint has a user-friendly interface, which makes it ideal for a beginner who does not feel overwhelmed when it comes to managing his or her finances.

Key Features

- Free complete budgeting.

- Automatic assignment of transactions.

- Credit score monitoring

Pros

- Completely free service

- Connects multiple accounts

- User-friendly interface

Cons

- Frequent promotional ads

- Poor investment monitoring.

- Basic customer support

Best For: Beginners

Pricing: Free

Website: https://mint.com

2. YNAB (You Need A Budget)

YNAB transforms the budgeting process by teaching individuals to assign all their money to specific tasks before spending. This is an active way of managing finances, as millions of people have escaped the paycheck-to-paycheck loop by doing so. In contrast to other financial management systems, which merely track expenditures after they occur, YNAB focuses on proactive planning.

The platform emphasizes saving for emergencies, eliminating debt, and maintaining a sustainable budget. Alongside its core budgeting features, YNAB integrates well with modern AI Risk Management Tools, offering users smarter insights into their financial habits and potential risks. The YNAB learning program also includes comprehensive tutorials, webinars, and educational resources that clearly explain the principles of budgeting.

Key Features

- Proactive budget planning

- Debt elimination tools

- Financial resources, including education.

Pros

- Superior budgeting technique.

- Strong educational support

- Debt reduction focus

Cons

- Subscription on a monthly basis is necessary.

- Steep learning curve

- Poor investment capital characteristics.

Best For: Budgeters

Pricing: $14.99/month

Website: https://youneedabudget.com

3. Personal Capital

Personal Capital is one of the financial management tools that has outstanding investment tracking abilities. The service is a combination of free financial tracking and optional wealth management services. It gives an in-depth account of investment portfolios, retirement planning tools, and net worth tracking of all accounts.

The advanced algorithms of Personal Capital calculate investment charges, asset allocation, and performance indicators neglected by most other applications. The platform has free services available to the self-directed user as well as premium advisory services where a user seeking professional advice may be advised.

Key Features

- Progressive investment monitoring.

- Retirement planning tools

- Net worth monitoring

Pros

- Excellent analysis on investment.

- Fully automated wealth management.

- Professional advisory services.

Cons

- Difficult interface in the first place.

- Limited budgeting features

- Frequent advisor calls

Best For: Investors

Pricing: Free (Premium services available)

Website: https://personalcapital.com

4. Quicken

Quicken is a financial management tool that has led the pack in the past thirty years and has survived by transforming with the needs of its users. The software has various versions that suit any financial scenario, from simple expense accounting to advanced financial administration of a business.

The desktop-based strategy offered by Quicken is powerful in terms of functionality that can hardly be compared with web-based tools. It is superior in terms of tracking transactions, investment tracking, tax preparation support, and bill management. Some of the account types supported on the platform are checking, savings, credit cards, loans, and investment accounts.

Key Features

- Extensive budget monitoring.

- Elaborated reporting functions.

- Investment portfolio management.

Pros

- potent desktop capability.

- Large scope of reporting.

- Long-established reliability

Cons

- Annual subscription cost

- Desktop-only limitation

- Complex for beginners

Best For: Power-users

Pricing: $35.99-$103.99/year

Website: https://quicken.com

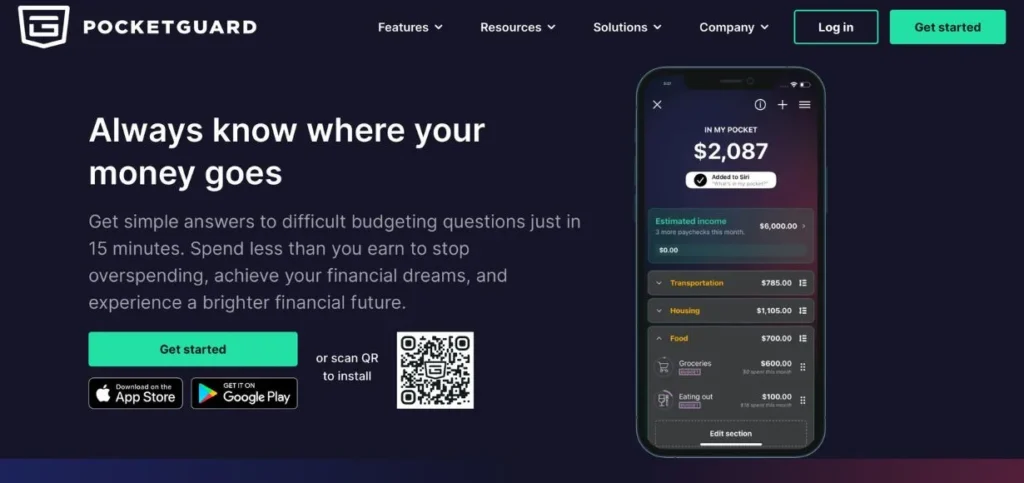

5. PocketGuard

PocketGuard is a device that makes the management of finances easy by answering a single important question: What can I spend? Such a specialized design is what makes it one of the easiest financial management tools that people should use when they desire simplicity and do not feel like compromising efficiency.

The app links to bank accounts and credit cards, which automatically track expenses and determine how much money one has to spend after deductions in the form of bills, goals, and needs. The In My Pocket feature offered by PocketGuard is used to give immediate advice on spending money to avoid incurring excess expenses.

Key Features

- Available spending calculator.

- Subscription tracking service: The records of the subscriptions that a user has made are managed by this service.

- Basic categorization of expenses.

Pros

- Extremely simple interface

- Instant spending guidance

- Efficient subscription control.

Cons

- Limited advanced features

- Simple reporting facilities.

- No investment tracking

Best For: Simplicity

Pricing: Free (Premium $7.99/month)

Website: https://pocketguard.com

6. Tiller

Tiller bridges the gap between automated financial management tools and manual spreadsheet control. The site will automatically load bank data into pre-built Google Sheets or Microsoft Excel templates, allowing users to have both the automation and the customization of spreadsheets. This distinctiveness will attract users who desire to have full control of their financial data and still not key in the data manually. Tiller has a number of pre-built budgeting, expense tracking, debt management, and financial reporting templates.

Key Features

- Spreadsheet integration is automated.

- Mutable financial templates.

- Flexible data manipulation

Pros

- Foremost ability to customize.

- Easy-to-use spreadsheet interface.

- Powerful data control

Cons

- Needs knowledge of spreadsheets.

- No mobile app

- Limited automated insights

Best For: Spreadsheet-lovers

Pricing: $79/year

Website: https://tillerhq.com

7. Goodbudget

Goodbudget is an envelope-based budgeting application that has been computerized, making it one of the simplest financial management applications among families and couples. The system allocates the money in virtual envelopes based on different types of expenditures, and this enables the user to be within set budgets. It is also a way of making the budget true and understandable, especially to people who may not have to deal with the aspect of financial management. No bank accounts are required in Goodbudget, and this gives customers complete personal access and control over their financial information.

Key Features

- Virtual envelope budgeting

- Multi-user family support

- Privacy-focused approach

Pros

- Intuitive envelope system

- Great for families

- No bank connection required

Cons

- Manual transaction entry

- Limited free version

- Basic reporting features

Best For: Families

Pricing: Free (Plus version $8/ 8/month)

Website: https://goodbudget.com

8. Banktivity

Banktivity offers Mac and iOS users a premium financial management tool experience with a beautiful design and powerful functionality. The platform offers extensive financial tracking, investment monitoring, and budgeting applications that are specially tailored to Apple devices. Banktivity has a clean interface, and it adheres to the Apple design principles, so it is easy to use for Mac and iPhone users.

The software has advanced features such as multi-currency, in-depth investment tracking, and advanced reporting features. The platform will allow users to keep track of the types of accounts they have, watch investment performance, a nd set up detailed budgets with spending notifications.

Key Features

- Apple-optimized design

- Tracking investment portfolios.

- Multi-currency support

Pros

- Beautiful Apple interface

- Vigorous investment capabilities.

- Great synchronisation of devices.

Cons

- Apple-only platform

- Higher price point

- Inadequate third-party integration.

Best For: Apple users

Pricing: $99.99 (one-time purchase)

Website: https://www.banktivity.com/

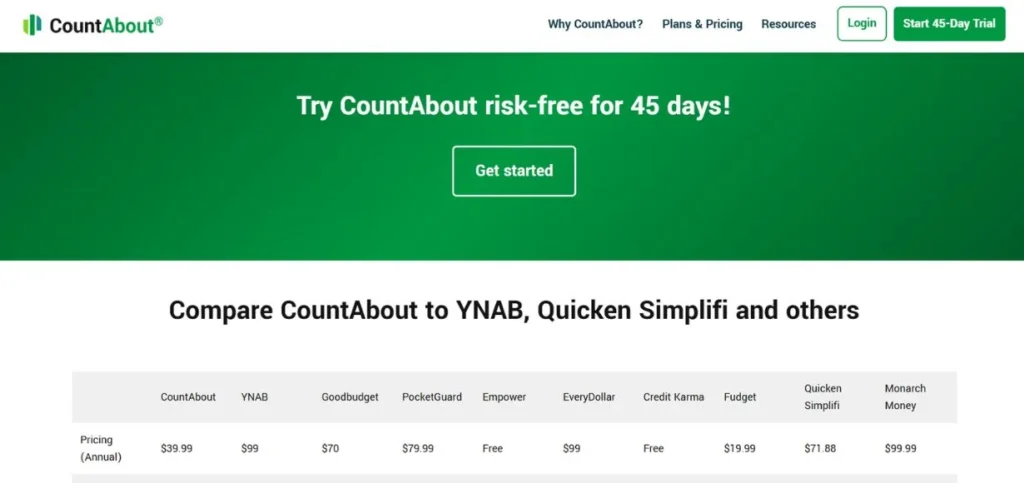

9. CountAbout

CountAbout is aimed at users who used the now-outdated financial management software, such as Microsoft Money, or those who were looking to leave some other platforms. The web-based solution provides familiar access with the current cloud-based convenience. CountAbout also allows importing data into the system in a wide range of formats, which significantly simplifies the process of migrating the existing tools.

The system has an all-inclusive expense tracking, budgeting, and a thorough reporting system. The users are allowed to add bank accounts and have automatic downloads of transactions, or add all the details manually to have total privacy.

Key Features

- Easy data migration

- Web-based accessibility

- Conventional financial monitoring.

Pros

- Simple migration process

- Familiar interface design

- Reliable basic features

Cons

- Limited modern features

- Basic mobile experience

- Fewer integrations are offered.

Best For: Migrators

Pricing: $9.95-$39.95/year

Website: https://countabout.com

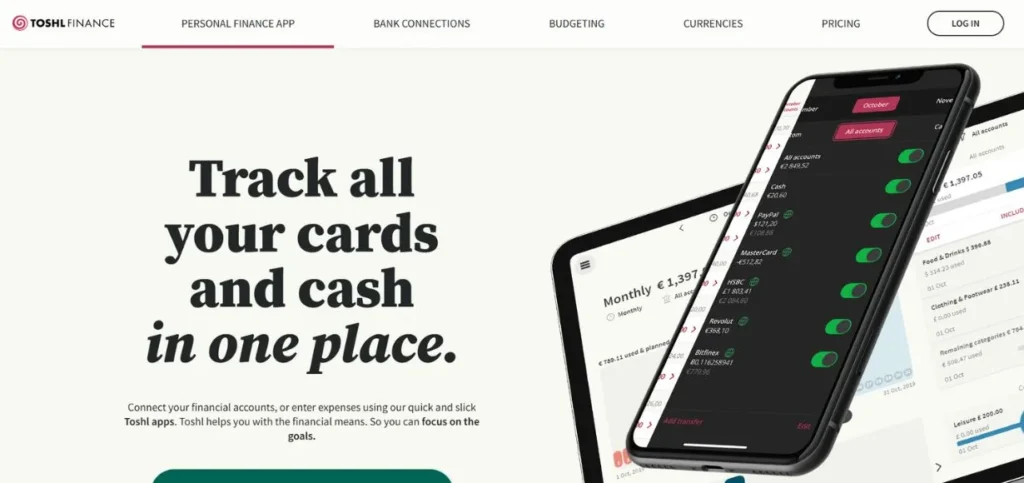

10. Toshl Finance

Toshl Finance is a blend of market-leading financial management and addictive gamification features, which make money management enjoyable. The system has colorful visualizations, achievement badges, and tracking of progress to encourage users to adopt improved financial habits. Integrated with AI Cloud Business Management Tools, Toshl enhances automation and intelligent analysis, helping users manage their finances more efficiently. It also supports the thorough monitoring of expenses in various currencies, which is why it is a great option for international people and travelers.

The platform offers information on spending, budgeting, and tracking goals in beautiful and easy-to-understand charts and graphs. Users are able to install different types of financial objectives, such as vacation savings, paying off debt, and this is accompanied by visual progress indicators, which keep one motivated.

Key Features

- Gamified money management

- Multi-currency support

- Stunning data charts.

Pros

- Engaging user experience

- It has excellent international features.

- Motivational progress monitoring.

Cons

- Poor tracking of investment.

- Premium features cost

- Smaller user community

Best For: International users

Pricing: Free (Pro versions $4.99-$9.99/month)

Website: https://toshl.com

Common Mistakes to Avoid

- Selecting Improperly Complicated Instruments: Use financial management tools that are not too complicated in features than you can reasonably use, because complicated ones can easily be discouraged.

- Ignoring Security Aspects: Do not compromise on security features when choosing the tools that will be used to get your sensitive financial information.

- Failure to establish a regular usage: Withdrawal to failure to utilize financial management tools always thwarts the end of this and prevents you from acquiring useful insights.

- Ignoring Mobile Accessibility: Select platforms with mobile applications or responsive design that will allow one to access platforms anywhere, anytime.

- Failure to Get Specific Goals: You should not have unrealistic financial expectations, which may cause frustration, and give up on the tools you have chosen.

Conclusion

The tools of financial management have changed the way we treat money, making the complex financial operations simple and easy to manage. These platforms provide answers to all financial conditions and abilities, where the simplest expense tracking is provided, along with a detailed analysis of investments.

The trick to success in the application of management tools is not only in selecting the appropriate platform, but in making regular use of it and adjusting it to your needs. Regardless of whether you are at the beginning of your financial life or you are aiming to optimize an already strong financial position, a perfect tool is undoubtedly waiting to assist you in meeting your goals.

Always keep in mind that the most effective financial management tools are those that you will use. Get a basic solution to suit your present requirements, and do not worry about upgrading or even changing it as your financial needs change.

The best things in life are your decisions today that will lead to future financial success, and the appropriate tools will make the difference between your success and failure. Secure your financial future by choosing the management tools that most suit you and your intended purpose. Your wallet will know you are very grateful.

Frequently Asked Questions

Are financial management tools safe to use?

A: Yes, the valid financial control tools have bank-level encryption and security to secure your data. Always use proven platforms whose track record on security is high, and through which you can only access your accounts.

Do financial management tools require any payment?

A: There are a lot of good financial management software programs that have free versions, but with simple features. The higher-end versions usually offer functionality such as investment tracking, in-depth reporting, and priority customer support.

Could it be true that financial management tools will help me get out of debt?

A: Absolutely. Financial management software are capable of tracking your debts, developing strategies to pay off, tracking the progress, and assisting you in understanding where you can incur fewer costs to increase funds towards debt repayment.

What is the frequency of access to financial management tools?

A: To ensure optimal results, be sure to check your financial management software at least once a week to review spending, update budgets, and keep track of the financial goals. Quick checks every day can be used to be aware of your spending habits.

Is it possible to combine several financial management tools?

A: Yes, there is a great number of people who apply various financial management software to various purposes. E.g., you can utilize a budgeting tool and an investment tracking tool. Nevertheless, a combination of excessive tools may prove counterproductive.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!