10 Best Finance Companies in Delhi | 2025

From the bustling streets of Connaught Place to the tech-driven corridors of Gurugram and Noida, Delhi-NCR is transforming into a financial ecosystem where tradition meets innovation. Whether you’re a seasoned investor, a budding entrepreneur, or simply someone trying to manage personal wealth, Delhi offers a range of opportunities through its diverse network of finance companies.

According to 2022 reports, Delhi ranked second in India’s startup ecosystem with 56 major investment deals, standing just behind Bengaluru. In fact, Delhi-NCR was officially crowned the digital payment capital of India, highlighting the region’s rapid embrace of technology-driven finance.

This blog explores the leading finance companies in Delhi—firms that not only offer a wide spectrum of services but also shape the future of financial management in India.

“Choosing the Right Finance Company in Delhi: Everything You Need to Know”

With a multitude of financial institutions operating in Delhi, finding the right one to suit your needs can be overwhelming. Whether you are looking for a personal loan, business funding, investment options, or digital financial services, making the right choice is crucial for your financial health.

1. Check for Regulatory Approval and Licensing

Ensure the finance company is registered with the Reserve Bank of India (RBI) or the Securities and Exchange Board of India (SEBI), depending on its type. Legitimate licensing not only ensures compliance but also protects your money from fraud.

2. Review Their Service Portfolio

Different companies specialize in different areas—some may focus on personal and business loans, while others provide wealth management, investment advisory, or fintech solutions.

3. Compare Interest Rates and Charges

Interest rates, processing fees, and hidden charges can vary significantly from one company to another. Compare offers and choose the one that is most transparent and cost-effective for your situation.

5. Consider Digital Accessibility and Innovation

If convenience is a priority, choose companies that offer strong online platforms or mobile apps.

6. Look for Personalized Support

The best finance companies offer dedicated customer support, financial advisors, or relationship managers. This can be especially helpful when dealing with complex investments or business financing.

7. Evaluate Flexibility and Customization

A good finance partner should be willing to tailor solutions to your unique needs. Whether it’s a flexible repayment plan or a customized investment portfolio, check if the company offers personalized options.

8. Reputation and Market Presence

A company’s history, years in business, and associations with major institutions can say a lot about its reliability. Established brands with a strong presence in Delhi are generally more trustworthy.

9. Transparency in Terms and Conditions

A trustworthy finance company will clearly outline all terms and conditions in writing. Watch out for vague language, hidden clauses, or unclear repayment structures—these can lead to disputes or financial stress later.

10. Speed of Processing and Disbursement

Time-sensitive needs require prompt service. Opt for companies known for fast approvals and disbursements, especially for short-term loans or emergency funding.

11. Range of Financial Products

A well-rounded finance company offers a diverse portfolio—mutual funds, insurance, credit lines, retirement planning, forex services, etc. This one-stop approach can save time and build long-term relationships.

12. Physical Presence and Accessibility

Even in the digital age, having a local branch or regional office in Delhi can be beneficial. It provides ease of access for documentation, in-person support, or legal recourse if required.

13. Strong Customer Grievance Redressal System

Issues may arise, and having a responsive customer care team or escalation matrix is essential. Check whether the company offers clear channels for resolving complaints or delays.

14. Financial Stability of the Company

Evaluate the company’s financial health by reviewing its credit ratings (from CRISIL, ICRA, etc.), past performance, and investor backing. This ensures that your money is in stable hands.

15. Security of Personal and Financial Data

Cybersecurity is non-negotiable. Make sure the company uses secure encryption protocols, adheres to data protection laws, and doesn’t misuse customer information.

List of Top Finance Companies in Delhi

1. Unbound Finance

Unbound Finance is an emerging decentralized finance (DeFi) platform that is making waves in India’s financial ecosystem, including its growing influence in cities like Delhi. Focused on building the next layer of DeFi infrastructure, Unbound Finance allows users to unlock liquidity from decentralized assets like liquidity pool (LP) tokens without needing to sell them.

This concept of “zero-interest loans” against LP tokens has positioned Unbound as an innovator in the blockchain-based financial space. While its operations are primarily digital and decentralized, Unbound’s connection with India’s tech and finance hubs—including Delhi—enables it to attract talent and partnerships from one of the country’s most prominent financial markets. Its emphasis on security, transparency, and smart contract-based lending makes it a standout among new-age finance firms contributing to Delhi’s growing role in digital finance.

Service Provided

- Zero-interest crypto loans

- Collateralization of LP tokens

- Stablecoin minting

- Liquidity farming support

- Cross-chain interoperability

- Smart contract-based lending

- DeFi asset management

- Protocol integrations

Contact Details

Website: https://unbound.finance/

Average salary: 5.2 lakhs

2. Hero FinCorp

Hero FinCorp is a rapidly growing non-banking financial company (NBFC) and a key player in India’s retail and corporate lending sectors. Headquartered in Delhi, the company is a subsidiary of the Hero Group and is known for offering a wide range of financial products including two-wheeler loans, used car financing, personal loans, SME loans, and working capital solutions.

Its presence in Delhi is particularly strong, with a network of branches catering to both urban and semi-urban customers. Hero FinCorp has gained a reputation for its quick loan disbursals, flexible repayment terms, and customer-centric approach, making it a preferred choice for individuals and small businesses in the capital.

Service Provided

- Two-Wheeler Loans

- Used Car Loans

- Personal Loans

- Business Loans

- SME Loans

- Loan Against Property

- Working Capital Loans

- Machinery Loans

- Secured and Unsecured Loans

- Inventory Funding

- Corporate Lending

- Bill Discounting

- Insurance Services

- Consumer Durable Loans

- Digital Loans

Contact Details

Average salary: 4.5 lakhs

Website: https://www.herofincorp.com/

Phone: +91-11-49487150

Fax: +91-11-49487197 / +91-11-49487198

Email: customer.care@herofincorp.com

Toll-Free: 1800-103-5271

Number: +91-92893-86204

3. BeeBee Advisory

BeeBee Advisory is a well-known financial advisory firm based in Delhi that provides comprehensive financial solutions to individuals and businesses. Specializing in wealth management, investment strategies, and financial planning, BeeBee Advisory helps clients navigate complex financial decisions and build long-term wealth. With a focus on personalized services, the firm offers tailored investment portfolios, tax planning, retirement solutions, and risk management strategies.

Their expertise in capital markets, coupled with a deep understanding of the evolving financial landscape, allows them to offer insightful advice and innovative financial products to cater to the unique needs of their clientele. Through their advisory services, BeeBee Advisory plays a key role in empowering clients to achieve their financial goals while ensuring steady, reliable growth in an ever-changing economy.

Service Provided

- Wealth Management

- Investment Strategies

- Financial Planning

- Tax Planning

- Retirement Solutions

- Risk Management

- Portfolio Management

- Capital Market Advisory

- Estate Planning

- Insurance Advisory

Contact Details

Average salary: 3.2 lakhs

Website: https://beebeeadvisory.com/

Email: sales@beebeeadvisory.com

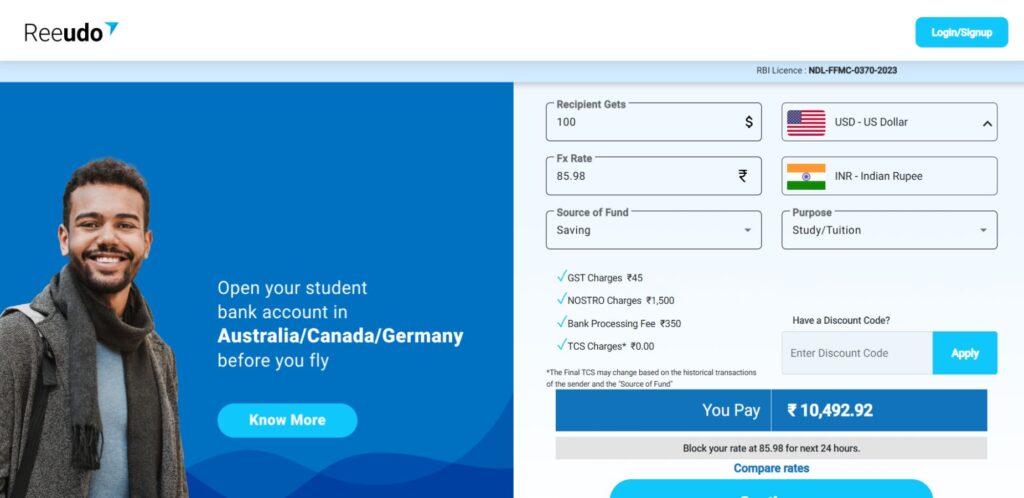

4. Reeudo

Reeudo is a dynamic finance company with operations in multiple Indian cities, including Delhi. Specializing in personal finance solutions, Reeudo focuses on simplifying the borrowing process through technology-driven services. The company offers a range of financial products such as instant personal loans, salary advances, and credit line facilities, primarily aimed at salaried professionals.

By leveraging digital tools for quick loan approvals and minimal documentation, Reeudo has made financial assistance more accessible and efficient for urban customers. In Delhi, a city known for its fast-paced economy and diverse workforce, Reeudo plays a crucial role in catering to the short-term credit needs of working professionals and young adults. Its customer-centric approach and transparent processes have helped it gain popularity among the emerging middle class seeking reliable and fast financial solutions.

Service Provided

- Instant Personal Loans

- Salary Advances

Credit Line Facilities - Digital Loan Processing

- EMI Payment Options

- Customer Support via App/Online Platform

Loan Tracking and Management Tools

Contact Details

Average salary: 7.8 lakhs

Website: https://www.reeudo.com/

Address: Unit No. 16, First Floor, Vipul Square, B-Block, Sushant Lok Phase I, Sector 43, Gurugram, Haryana 122009, India.

Phone: +91 99588 66831

Email: support@reeudo.com

Website: www.reeudo.com

5. Clix Capital

Clix Capital is a dynamic non-banking financial company (NBFC) headquartered in Delhi, known for its innovative and technology-driven financial solutions. The company offers a broad range of financial products including personal loans, business loans, equipment financing, and healthcare financing.

Clix focuses on leveraging digital platforms and data analytics to ensure quick, hassle-free loan approvals, making it particularly popular among millennials and small business owners. With its strong customer-centric approach and emphasis on financial inclusion, Clix Capital is playing a significant role in reshaping the lending landscape across urban and semi-urban India, especially from its base in Delhi.

Service Provided

- Personal Loans

- Business Loans

- MSME Loans

- Equipment Financing

- Healthcare Financing

- Education Loans

- Digital Lending Solutions

- Consumer Durable Loans

- Working Capital Loans

- Loan Against Property

Contact Details

Average salary: 12.9 lakhs

Website: https://www.clix.capital/

Toll-Free Number: +91-120-6465400

Alternate Contact: +91-124-4740870

WhatsApp Support: +91-8448111444

Email: hello@clix.capital

6. AffordPlan

Focused on enabling affordable and planned healthcare, AffordPlan partners with hospitals and clinics to provide customized savings plans and zero-interest EMIs for medical treatments. This innovative approach bridges the gap between healthcare providers and patients, making quality healthcare more accessible to the middle and lower-income segments.

By operating at the intersection of finance and healthcare, AffordPlan plays a vital role in financial inclusion and has expanded its footprint across multiple Indian cities, including Delhi, where it continues to serve as a key player in the city’s growing fintech ecosystem.

Service Provided

- Zero-interest EMIs

Medical savings plans - Healthcare financing

- Partnership with hospitals

- Digital payment solutions

- Prepaid healthcare cards

- Treatment cost estimation

- Patient financial counseling

Contact Details

Phone Number: +91 92500 50501

Email: tej@affordplan.co

Average salary: 8.9 lakhs

Website: https://www.affordplan.com/

7. Junio

Delhi, the capital city of India, is home to some of the most prominent finance companies in the country. From legacy institutions like State Bank of India and HDFC to modern fintech disruptors like Paytm and Junio, Delhi’s financial ecosystem is dynamic and diverse. Junio, in particular, is gaining attention as a fintech startup focused on providing digital payment solutions and financial literacy tools for children and teens.

By offering prepaid cards and app-based money management for youngsters, Junio is helping shape the future of financial responsibility among the younger generation. The broader presence of finance companies in Delhi contributes significantly to the national economy through job creation, investment flows, and innovation in digital banking and lending.

Service Provided

- Personal Loans

- Business Loans

- Home Loans

- Auto Loans

- Wealth Management

- Insurance (Life, Health, General)

- Mutual Funds

- Credit Cards

- Fixed Deposits

- Stock Trading

- Investment Banking

- Corporate Banking

- Gold Loans

- Retirement Planning

- Education Loans

- Foreign Exchange (Forex)

- Asset Management

- Loan Against Property

- Digital Payments

- Peer-to-Peer Lending

Contact Details

Average salary: 8 lakhs

Website: https://junio.in/

Address: New Delhi, Delhi, 110001, India

Email: hi@junio.in

8. VLS Finance

The organization has established a good reputation in the financial world with its diversified services, which are stock broking, proprietary investments, equity research, investment banking, and corporate consulting. Its subsidiary company, VLS Securities Ltd., is a registered stock broker of SEBI and a Category I merchant banker and provides comprehensive financial advisory services. VLS Finance is reputed for its proprietary investments in diverse sectors like media, IT, healthcare, logistics, real estate, and FMCG. Significant investments include shares in firms such as Accelya Kale Solutions, International Amusement Ltd.

Service Provided

- Stock Broking

- Investment Banking

- Equity Research

- Proprietary Investments

- Corporate Advisory

- Merchant Banking

- Portfolio Management

- Financial Consultancy

- Underwriting Services

- Venture Capital Investment

Contact Details

website: www.vlsfinance.com.

Phone: +91-11-46656666

Fax: +91-11-46656699

Email: vls@vlsfinance.com

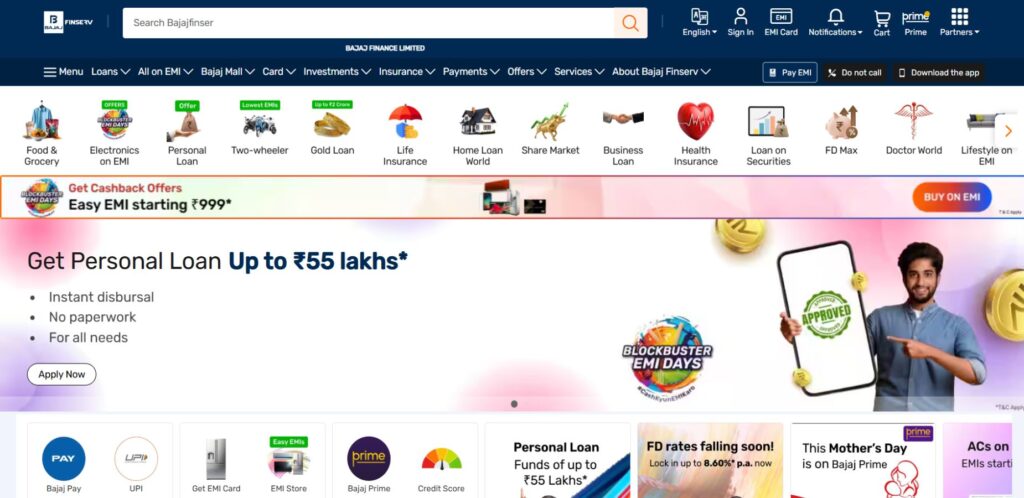

9. Bajaj Finserv

Bajaj Finserv is one of India’s leading financial services companies, with a strong presence in both Pune and Delhi. Bajaj Finserv offers a comprehensive range of financial products, including personal loans, business loans, insurance, and investment solutions. Its digital platforms and customer-friendly services have made it a go-to brand for many individuals and businesses looking for quick, reliable financial services.

The company has been able to tap into the growing demand for easy access to credit, with quick loan disbursements and flexible repayment options. Bajaj Finserv’s robust online presence also aligns with Delhi’s tech-savvy consumers, providing a seamless digital experience. As one of the top finance firms in India, it has contributed significantly to the financial inclusion and growth of the city’s economy, offering competitive solutions for both personal and corporate financial needs.

Service Provided

- Personal Loans

- Business Loans

- Home Loans

- Health Insurance

- Life Insurance

- Fixed Deposits

- EMI Cards

- Mutual Funds

- Loans Against Property

- Investment Advisory Services

- Digital Gold

- Consumer Durable Loans

Contact Details

Email Addresses

investor.service@bajajfinserv.in

investors@bajajfinserv.in

Average salary: 1.4 lakhs

Website: https://www.bajajfinserv.in/

10. IFCI

IFCI (Industrial Finance Corporation of India) is one of the prominent finance companies based in Delhi that has played a crucial role in the country’s industrial financing landscape. Established in 1948, IFCI was the first development finance institution (DFI) in India, aimed at providing long-term credit to industries and fostering industrial development. Over the years, IFCI has expanded its operations to offer a wide range of financial services, including project finance, infrastructure financing, and asset management.

The company primarily focuses on funding the industrial and infrastructure sectors, helping businesses scale operations and contribute to economic growth. IFCI’s role in financing large-scale projects has made it a key player in India’s economic transformation, especially in the post-independence period. Today, it is involved in corporate and retail financing, as well as offering structured financial products to meet the needs of modern industries.

Service Provided

- Project Finance

- Infrastructure Financing

- Corporate Loans

- Asset Management

- Financial Advisory

- Investment Banking

- Retail Financing

- Venture Capital

- Structured Finance Products

Securitization Services

Contact Details

CIN ID: L74899DL1993GOI053677

Phone Numbers:

- +91-11-4173 2800

- +91-11-4173 2000

- +91-11-2648 7444

Fax Number:

91-11-2623 0201

Average salary: 4 lakhs

Website: https://www.ifciltd.com/

How to Apply for Jobs in Finance Companies in Delhi?

Applying for jobs in finance companies in Delhi can be a rewarding career move, given the city’s dynamic financial landscape and its role as a major business hub. Below is a guide on how to navigate the job application process in finance companies in Delhi:

1. Research Potential Employers

Before applying, it’s important to identify the finance companies in Delhi that align with your career goals. These may include large banks, investment firms, insurance companies, fintech startups, and other financial institutions. Popular companies in Delhi’s financial sector include HDFC Bank, ICICI Bank, Axis Bank, and fintech companies like Paytm, Policybazaar, and others.

Start by visiting the company websites, reviewing their job openings, and understanding their business culture and values.

2. Update Your Resume and LinkedIn Profile

Emphasize your understanding of financial concepts, data analysis, accounting principles, and any specific software tools you are proficient in, such as Excel, financial modeling tools, or industry-specific software.

3. Explore Job Portals and Career Websites

Job portals such as Naukri.com, Monster India, Indeed, and Glassdoor list numerous job openings for finance professionals in Delhi. Set up alerts for finance-related roles that match your profile.

Additionally, visit the “Careers” section of finance companies’ websites, as they often post openings directly. Some companies also provide internship opportunities, which can be a good entry point into a full-time role.

4. Leverage Networking

Attend industry conferences, seminars, and career fairs in Delhi. Connect with professionals and recruiters in the finance field, either in person or via LinkedIn. Often, job opportunities are not advertised publicly but can be accessed through connections and referrals.

5. Prepare for Interviews

Once you secure an interview, be prepared to discuss your technical knowledge, problem-solving abilities, and understanding of the financial industry. Employers may also assess your soft skills, such as communication, teamwork, and adaptability.

Keep yourself updated on current trends and news within the finance industry, as you may be asked to comment on recent market developments, regulations, or new technologies.

6. Apply Directly to Finance Companies

Many leading finance firms have specific recruitment processes. You can apply through their career portals by uploading your resume and filling out an application form. Some companies may require you to take online assessments or technical tests as part of their hiring process.

7. Use Recruitment Agencies

Several recruitment agencies specialize in hiring for the finance sector. Partnering with such agencies can help streamline your job search. Agencies like Michael Page, Randstad, and Kelly Services have dedicated finance divisions and can connect you with suitable job opportunities in Delhi.

8. Focus on Specializations

Finance is a vast field with various specializations such as corporate finance, investment banking, accounting, risk management, asset management, and financial analysis. Identifying a niche area you are passionate about or specialized in can help narrow down job opportunities and increase your chances of finding a role that suits your expertise.

9. Follow-Up on Applications

After applying for a job, make sure to follow up with a polite email, expressing your continued interest in the role. This helps keep your application on the radar of the hiring team.

10. Prepare for Financial Certifications

Many finance companies in Delhi prefer candidates with certifications such as CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or other industry-recognized qualifications. If you haven’t already, consider pursuing such certifications to enhance your chances of landing a job in a competitive finance job market.

By following these steps, you can effectively apply for jobs in finance companies in Delhi and increase your chances of finding a role that aligns with your career aspirations.

Conclusion

Delhi, with its strategic location and status as the nation’s capital, has emerged as a thriving hub for finance companies across various sectors. The presence of numerous well-established financial institutions, from traditional banks to innovative fintech startups, has significantly contributed to the economic growth of the city and the country at large. These firms offer a broad spectrum of services, ranging from corporate finance and investment banking to asset management and retail lending, meeting the diverse needs of businesses and individuals alike.

The continued expansion of finance companies in Delhi not only strengthens its position as a key financial center in India but also attracts foreign investment, fosters job creation, and drives technological innovations within the financial ecosystem. With its robust infrastructure and talent pool, Delhi is poised to remain a key player in shaping the future of finance in India. For professionals and businesses, the city’s finance sector offers ample opportunities to grow and succeed, making it an exciting place for anyone looking to tap into the world of finance.

In conclusion, as the city continues to develop, Delhi’s finance companies will remain crucial in contributing to the overall economic progress, ensuring that it stays competitive on both national and international fronts.

Also Read: Finance Companies in Jaipur

FAQs

1. Do finance companies in Delhi hire freshers?

Yes, many finance companies in Delhi hire freshers, especially for roles in financial analysis, accounting, and customer support. Internships and entry-level positions are common pathways for freshers to enter the industry. Candidates with relevant academic qualifications, strong analytical skills, and a keen interest in finance can find suitable opportunities.

2. How can I find job openings in finance companies in Delhi?

Job openings in finance companies in Delhi can be found through several channels:

- Company websites: Check the career section of finance firms for the latest vacancies.

- Job portals: Websites like Naukri.com, Monster India, LinkedIn, and Indeed regularly list finance-related jobs.

- Networking: Attending industry events and connecting with professionals on LinkedIn can open doors to unadvertised positions.

3. What qualifications are required to work in finance companies in Delhi?

For more specialized roles, certifications such as CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or MBA in Finance are often preferred. Additionally, skills in data analysis, financial modeling, and proficiency in software tools like Excel and financial management software are highly valued.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!