How to Start a Trust in India: Step-by-Step Guide to Registration and Compliance

Are you dreaming of creating a lasting impact on society while also securing your hard-earned assets for future generations? Trusts not only offer a powerful way to support causes close to your heart — like education, healthcare, and social welfare — but they also provide a legal framework to manage and protect your wealth. If you’ve been wondering how to channel your passion for giving back in a structured, legally sound way, establishing a trust is an incredible place to start.

Between the legal jargon, paperwork, and compliance requirements, it’s easy to feel lost. How to start a trust in India is a common question, and this comprehensive book has all the answers. Everything you need to know about establishing a trust in India will be covered—from creating a solid trust deed to obtaining formal registration. Whether you want to safeguard your family’s future, maximize your philanthropic impact, or simply understand how trusts work, this guide will make the process simple, approachable, and achievable.

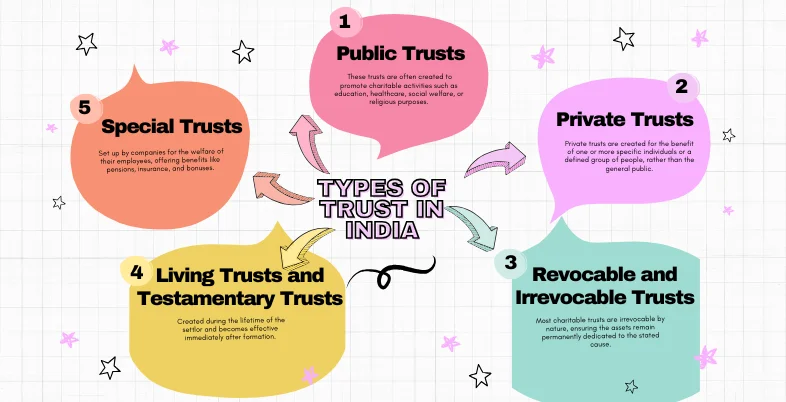

Types of Trust in India

In India, trusts can be broadly classified based on their purpose, structure, and legal framework. Understanding the different types of trusts is crucial because it helps you choose the one that aligns best with your goals — whether they are charitable, private, or related to asset protection. Here’s a clear breakdown:

1. Public Trusts

These trusts are often created to promote charitable activities such as education, healthcare, social welfare, or religious purposes.

- Charitable Trusts: Focused on activities like promoting education, providing medical relief, advancing arts and culture, or helping the poor.

- Religious Trusts: Established for promoting and maintaining religious activities, temples, or religious events.

Public trusts in India are regulated under various state laws like the Bombay Public Trusts Act, 1950, and related regulations, depending on the region.

2. Private Trusts

Private trusts are created for the benefit of one or more specific individuals or a defined group of people, rather than the general public.

3. Revocable and Irrevocable Trusts

- Revocable Trusts: During their lifetime, the settlor, or trust creator, is still entitled to change, amend, or dissolve the trust.

- Irrevocable Trusts: Once created, these trusts cannot be changed or revoked easily.

- Most charitable trusts are irrevocable by nature, ensuring the assets remain permanently dedicated to the stated cause.

4. Living Trusts and Testamentary Trusts

- Living Trusts (Inter Vivos Trusts): Created during the lifetime of the settlor and becomes effective immediately after formation.

- Testamentary Trusts: Created through a will and come into effect only after the settlor’s death.

5. Special Trusts

- Employee Welfare Trusts: Set up by companies for the welfare of their employees, offering benefits like pensions, insurance, and bonuses.

- Debenture Trusts: Established to protect the interests of debenture holders in a company, ensuring repayment and proper asset management.

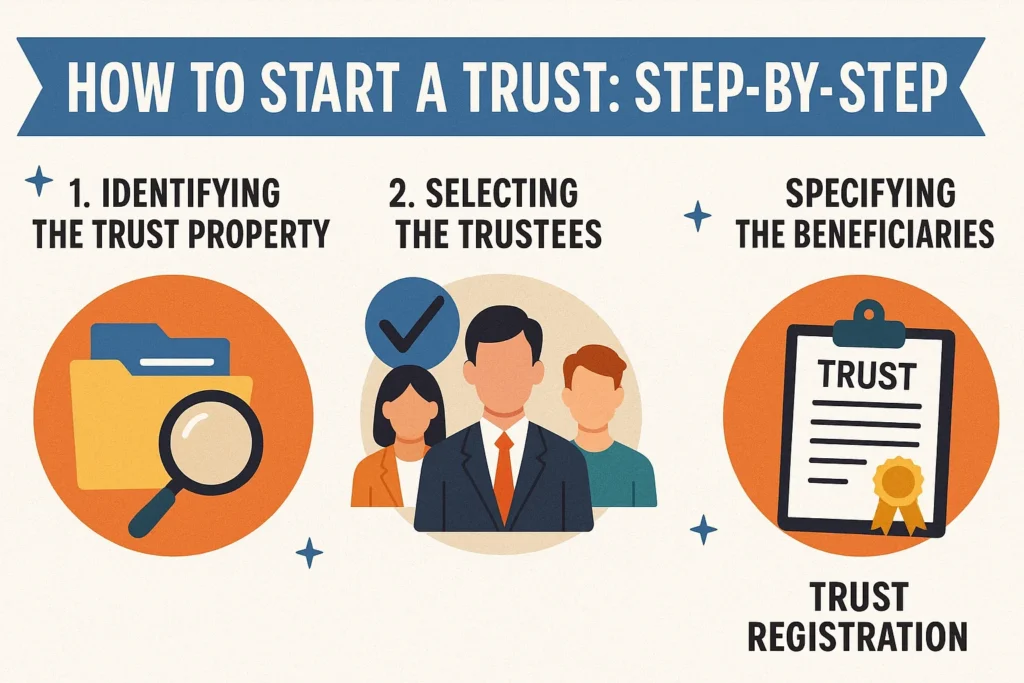

How to Start a Trust: Step-by-Step

It acts as the blueprint that defines the structure, purpose, and functioning of the trust, ensuring clarity and legal standing for all involved parties.

At its core, the trust deed clearly outlines the objectives of the trust — whether it is intended for charitable activities, managing family wealth, supporting education, healthcare, or any other purpose. The goals must be stated explicitly to guide the trust’s operations and legal obligations.

Another crucial part of the trust deed is laying down the management rules. These rules govern:

- How the trust will operate,

- How decisions will be made,

- How assets will be administered,

- How distributions to beneficiaries will occur,

Given the legal complexities involved, it is highly advisable to engage a qualified legal professional when drafting the trust deed. A lawyer ensures that the document is compliant with the Indian Trusts Act, 1882 and any other applicable laws. Proper drafting protects the trust against potential disputes, ensures smooth functioning, and preserves the settlor’s original intentions.

1. Identifying the Trust Property

When creating a trust, the settlor must clearly identify and allocate the assets or property that will form the trust’s corpus. Movable assets may consist of bank accounts, mutual fund investments, shares, and other financial instruments. On the other hand, immovable assets can include land, buildings, and other types of real estate. It is essential to gather proper documentation proving ownership and establishing the value of these assets to substantiate their inclusion in the trust.

Clearly defining the trust property is crucial, as it delineates the exact resources that will be managed by the trustees and utilized for the benefit of the beneficiaries. Proper documentation and clarity at this stage help avoid future disputes and ensure smooth administration of the trust.

2. Selecting the Trustees

When selecting trustees, it is essential to consider their trustworthiness, integrity, competence in managing financial and administrative affairs, understanding of fiduciary responsibilities.

The trust deed must clearly outline the procedure for the appointment and removal of trustees, in addition to specifying their powers, duties, and responsibilities. It is equally important that trustees are fully aware of their roles and formally agree to operate within the framework laid down by the trust deed and applicable law.

3. Specifying the Beneficiaries

It is crucial that the trust deed clearly identifies these beneficiaries, outlining who they are, what entitlements they have, and how they will benefit from the trust assets. In the case of a private trust, the beneficiaries are usually specific individuals, often family members or close associates. On the other hand, in a public or charitable trust, the beneficiaries could include a broader section of society, such as students, senior citizens, or the underprivileged.

Clearly defining the beneficiaries in the trust deed is essential to ensure that the trust fulfills its intended purpose, provides transparency, and offers the trustees a clear framework to administer .

4. Trust Registration

The first step is ensuring that the trust deed is executed on non-judicial stamp paper of the appropriate value, which varies depending on the state laws. Once the deed is drafted, it needs to be submitted to the Sub-Registrar’s office in the area where the trust’s registered office is located. Along with the trust deed, you’ll need to provide identification proofs (such as PAN cards and Aadhaar cards) of the settlor (the creator of the trust) and the trustees. You will also be required to pay the registration fees, which are typically a nominal percentage of the trust’s value, again depending on state laws.

Once the documents are verified and processed, the Sub-Registrar will issue a registration certificate, officially recognizing the trust. This certificate marks the legal birth of the trust and grants it the authority to own property, carry out transactions, and interact with financial institutions and tax authorities. The legal recognition also ensures that the trust can carry out its operations smoothly, facilitating greater transparency and accountability in its dealings.

Suggested read: Earning Apps Without Investment

Benefits of Starting a Trust in India

Starting a trust in India offers a wide range of benefits, both for individuals who want to manage their assets and for those aiming to contribute meaningfully to society. Whether you are planning for estate management, philanthropic activities, or tax efficiency, a trust provides a structured and legally sound framework to achieve your goals. Let’s explore the key advantages:

1. Asset Protection

By transferring property or wealth into a trust, the settlor ensures that these assets are managed responsibly and are safeguarded from potential legal claims, creditors, or mismanagement. This is especially important for individuals who wish to secure their family’s financial future or shield their assets from unforeseen risks.

2. Estate Planning and Succession

Trusts offer a smooth mechanism for succession planning. Instead of going through complex inheritance procedures, assets held in a trust are distributed to beneficiaries according to the terms outlined in the trust deed. This minimizes family disputes and ensures that the settlor’s wishes are honored without the delays often associated with probate or court procedures.

3. Tax Benefits

Charitable trusts registered under the Income Tax Act may enjoy significant tax exemptions. Donations made to eligible trusts are often deductible under Sections 80G and 12A of the Act, offering advantages both to the trust and its donors. Additionally, trusts can optimize tax liability on income generated from trust-owned properties or investments.

4. Philanthropy and Social Impact

For those inclined towards social welfare, setting up a public charitable trust provides a powerful platform to make a lasting impact. Trusts can support causes such as education, healthcare, poverty alleviation, women’s empowerment, and environmental protection, reaching underserved communities effectively and consistently.

5. Legal Recognition and Credibility

A registered trust gains legal recognition, which greatly enhances its credibility in the eyes of government agencies, donors, and financial institutions. This legal standing allows the trust to enter into contracts, acquire property, open bank accounts, and apply for grants or foreign contributions.

6. Perpetual Existence

Even if the original trustees resign, pass away, or are replaced, the trust continues to function seamlessly, providing stability and longevity to its mission.

7. Minimal Regulatory Burden

Compared to other forms of nonprofit organizations like societies or Section 8 companies, trusts generally face less stringent regulatory requirements. Annual compliance requirements are relatively simple, making trusts an attractive option for individuals seeking a straightforward yet effective organizational structure.

Conclusion

How to start a trust in India is a common question for those looking to manage family assets, plan for succession, or support charitable causes. Creating a trust in India is a deliberate and calculated move. With clear legal guidelines and a structured registration process, creating a trust has become more accessible than ever. Trusts not only offer protection and tax benefits but also provide an enduring legacy that can benefit generations to come.

By understanding the types of trusts, following the correct legal steps, and recognizing the immense benefits they offer, you can set up a trust that fulfills your personal, financial, or philanthropic goals. With proper planning and guidance, your trust can become a powerful tool for both wealth management and societal good.

FAQs

Can a family member be a trustee?

Yes, family members can be appointed as trustees. In fact, in private family trusts, trustees are often close relatives who manage the trust for the benefit of other family members.

Is there a difference between a private trust and a public trust?

Yes. A private trust benefits specific individuals (like family members), while a public trust is created for the general public’s welfare, such as promoting education, healthcare, or religion.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!