20 Best Cash Advance Apps Like Dave for Early Paychecks in 2026

Managing money is hard today. We are all subjected to such surprises as car repairs or pre-pay bills. Previously, one would need to borrow money through a friend or a high-interest payday loan. In 2026 however the money world is different.

Apps like Dave, cash-advanced apps have become quite popular. They advance you money that you have earned in advance before your payday. They are fast, less expensive than overdraft charges and can be placed in your phone.

Industry Snapshot (2025-2026):

- Market Growth: Cash-advance apps will be valued at over $7.6 B in 2024 and will top nearly 25B by 2035.

- User Adoption: Over 30% of consumers in the United States of America have utilized a cash-advance or earned-wage service within the past year.

- Fees Savings: The annual savings would be approximately $1B with the apps in comparison to the overdraft fee, which would average 35 dollars per incidence.

This guide simplifies it all; know all about the most popular applications like that of Dave in 2026 so that you can select the best to use.

Why are many people trying to find apps like Dave?

Individuals desire applications such as Dave not only to gain free money, but to be versatile and survive in the modern day economy. Here’s why they’re popular:

- How to avoid the Overdraft Trap: Banks impose huge fees, say, 35 or more when you exceed your balance by one dollar. Applications such as Dave will offer you a little cushion, which can be in the form of 50 or 100 dollars, to cover that difference, saving you high charges that will accumulate to debt.

- Inflation and Cost of Living: A strict budget may not work in times of change of the prices of groceries and rent. These applications bridge the loophole between paychecks and a lengthy loan application.

- No Credit Checks: Cash-advance apps do not tough your credit too hard. Therefore they can be used by individuals with rebuilt credit or those with no credit history.

- Speed and Convenience: In 2026, nobody will be taking a loan of less than 50 dollars to a bank. You desire an instant cash and a button to your phone. These apps do that.

How We Evaluate apps like dave for cash advance

In order to make this top 20 list, we considered the features that are important to the everyday users. Not only marketing but also fine print.

- Advance Limits: What is the limit you can have? The prices of some apps begin at $20, others reach up to $500 or higher.

- Speed of Funding: Is it possible to get money immediately? In case yes, is there a charge on expedited delivery?

- Costs and Fees: We verified subscription fee, tipping system and undisclosed expenses. We favored transparent apps.

- Easy to Qualify: Does the app require a specific direct deposit? Does it apply to gig workers such as Uber drivers or regular employees only?

- Extra benefits: We awarded extra points to applications that have budgeting, credit building, or side-hustle finder options.

Comparison Table — Important Features and Strengths

The comparison with the best apps is done below to see how they compare.

| Company Name | Key Features | Specialization | Strengths |

|---|---|---|---|

| EarnIn | Balance Shield, Lightning Speed, Health Aid | Early wage access | High limits, no fees, fast transfers |

| Brigit | Auto Advances, Credit Builder, Financial Scorecard | Overdraft prediction & cash advances | No credit check, strong budgeting tools |

| MoneyLion | Instacash, Credit Builder Plus, Round-Ups | Full-suite finance + cash advance | High limits, banking + investing features |

| Chime | SpotMe, Early Direct Deposit, Credit Builder | Fee-free mobile banking | No fees, overdraft protection |

| Empower | Instant Advance, AutoSave, AI Spending Insights | Budgeting + cash advance | Clean UI, automated savings |

| Klover | Points System, Spending Insights, Sweepstakes | Data-driven free cash advance | No fees, fun gamified experience |

| Albert | Albert Instant, Genius Experts, Smart Savings | Human-assisted financial planning | Real advisors, instant cash |

| Varo | Varo Advance, Early Deposit, High-Interest Savings | Mobile banking + cash advances | Transparent fees, higher advance limits |

| Cleo | Roast Mode, Salary Advance, Credit Builder | AI budgeting & fun money assistant | Engaging UX, no credit check |

| Payactiv | Earned Wage Access, Bill Pay, Daily Access | Employer-based early wage access | Cheapest when employer-supported |

| FloatMe | $20–$50 advances, Overdraft Alerts, Smart Saves | Micro cash advances | Simple, fast, very low-cost |

| Possible Finance | Installment Loans, Credit Reporting | Installment loans for bad credit | Builds credit, flexible repayments |

| DailyPay | Real-time earnings balance, Any-account transfers | Employer-based earned wage access | Safe, widely used by big companies |

| Branch | Instant Pay, Fee-Free Banking, Cash Back | Gig worker banking | No subscription, instant debit card |

| Current | Overdrive, Points Rewards, Savings Pods | Teen + adult mobile banking | Good overdraft + high savings rate |

| Grid Money | Tax Optimization, Cash Advances, Debt Tools | Tax-based income boosting | Unique model, credit building |

| SoLo Funds | P2P Lending, Flexible Terms, Community Rating | Peer-to-peer cash lending | Community trust, flexible tips |

| One@Work (Even) | Instapay, Auto Budgeting, Savings Goals | Employer-based budgeting + early pay | Highly accurate budgeting |

| Money max | $20–$200 loans, P2P Payments, Investing | Micro-loans + payments | Instant cash, very user-friendly |

| Gerald | Bill Advance, Subscription Tracking, Rewards | Bill protection & subscription control | Helps avoid service interruptions |

Leading 20 Apps Like Dave for 2026

Below is a mere mention of the top 20 apps that you may be interested to explore in 2026.

1. EarnIn

EarnIn was among the earliest apps like dave to allow you to receive a portion of your paycheck prior to the official paycheck. It takes your bank account and your working hours to calculate what you can use at the moment. Tapping the cash out button, EarnIn will charge that to the next paycheck.

Key Features:

- Balance Shield: It will make an alert when your bank balance is nearly empty.

- Lightning Speed: Instills money in your wallet in less than minutes at a small fee.

- Health Aid: Can be used to negotiate medical charges.

Pros:

- Large limits (maximum of 750/pay period).

- No interest or monthly fees.

- Works with hourly workers and salaried workers.

Cons:

- Requires time sheets or definite work place (GPS).

- Must be deposited on a regular basis.

Pricing: Pay what you consider to be fair (tipping model). Instant transfer with lightning speed fees.

Best For: Ordinary employees who desire the largest withdrawal limits.

2. Brigit

Brigit will save you the overdraft charges because it will tell you when you are going to be short of cash before your next payday. It will automatically either give you a cash loan or warn you in case it perceives a threat. It is a 24/7 financial watchdog.

Key Features:

- Auto Advances: The amount is automatically transferred in case you are in danger of overdrafting.

- Credit Builder: Credit building tools (paid version).

- Everything: A Scorecard of your financial health.

Pros:

- Fast approval.

- No credit check.

- Good budgeting tools.

Cons:

- The free version is highly restrictive (primarily surveillance).

- Cash advances will entail the $9.99 monthly fee.

Pricing: Free alerts, Plus (advances and credit builder): $9.99/month.

Best for: People who forget bills or frequently get overdrafted.

3. MoneyLion

MoneyLion is a full-fledged financial one of the best apps like dave applications. It provides a bank account, investment and credit building services. Its Instacash rival to Dave can provide you with up to 1000 dollars in case you use RoarMoney bank account.

Key Features:

- Instacash: $1,000 to $1,000 with the RoarMoney account, less with other financial institutions.

- Round-Ups Round-ups can sell spare change automatically to a crypto or investment account.

- Credit Builder Plus: A loan to boost your credit score.

Pros:

- Very high limits.

- Wide range of tools.

- Instant funding options.

Cons:

- A lot of the features may seem cluttered.

- Instant delivery may be expensive in terms of turbo fees.

Pricing: Pay as you wish; Turbo pricing depending on the amount; membership charges on Credit Builder.

Best for: The best is suited to the user who wants high amounts of cash limits and an integrated banking experience.

4. Chime

Chime is a bank analogue application that has a SpotMe feature that allows you to overdraft your debit card without charges. It would automatically work after you have direct deposits. As one of the popular apps like Dave, it also fits naturally into the category of payday advance apps because it gives users early access to funds and fee-free overdraft support.

Key Features:

- SpotMe: No charge on overdrafting card purchases and ATM withdrawals.

- Get Paid Early: Direct deposits may be received as much two days ahead.

- Credit Builder Card: This is a secured card in which you deposit your funds to build credit.

Pros:

- No monthly fees.

- No interest.

- Ease of integration with the banking.

Cons:

- Has to change to Chime to utilize SpotMe.

- The initial limits are low (20) and increase with time.

Pricing: Free to use: Free (with optional tips); SpotMe.

Best For: Individuals who are willing to transfer their banking to a no fee overdraft service.

5. Empower

Empower is a simple and clean one of the apps like dave that assists you to control your money. It provides you with fast loans and has an artificial intelligence assistant that monitors your spending. The app has a reputation of offering an easy way to get money when you are in need it is called Cash Advance, and the AutoSave feature that examines your income and bills to find small amounts you can save without concern is quite popular among users. It allows you to borrow when you have the need, and it teaches you to save so that you can not have to borrow in the future.

Key Features:

- Instant Advance: Learn to get up to $250.

- AutoSave: Autosavings to save you a little of your money.

- Smart Recommendations: Recommends you the amount of money you can spend within the week.

Pros:

- Extremely clean and user-friendly interface

- Instant delivery is possible

- Outstanding automation of savings.

Cons:

- It needs a subscription fee of $8 per month after their free trial

- The customer support is primarily chat-based.

Pricing: It starts at $8/month subscription with no interest payment or late charges.

Best for: This is best used by those users who need a powerful budgeting assistant to complement their cash advance.

Link:

6. Klover

Cash loans are a service provided by Klover one of the apps like dave . Rather than charging interest, it provides you with money in case you allow it to examine your expenditure information to conduct research. It also has its points system in which you earn points by watching advertisements or completing small activities to increase your loan limit. It is more of a game: you are assisting the app and it will give you free cash. It is acceptable to individuals with tight budgets who do not want to pay fees.

Key Features:

- Points System: Earn points in order to increase your advance limit or pay cover fees.

- Spending Insights: It displays how your money is spent in easy to understand charts.

- Daily Sweepstakes: Daily it is possible to win some small sums of money.

Pros:

- There is no credit inquiry

- There is no interest

- You can earn a higher limit without greater earnings

- It is amusing and entertaining.

Cons:

- Lower limits to start with

- Involves sharing data (albeit anonymized) watching advertisements can be irritating to some.

Pricing: Free basic service; Plus membership at an additional cost; express fees are available.

Best for : Gig workers or even students who can find the time to use the app to save money.

7. Albert

Albert is a so-called Genius apps like dave that can be put in your pocket. It one of the loan apps that offers cash loans up to $250. The key characteristic of it is its Albert Genius, which are real individuals who can write you some financial advice. In case of any doubt about shoe purchases or investments, the Albert team is on hand. Cash feature called Albert Instant is smooth, however, the best thing about the app is that it is useful when you work with it as a full-fledged money planner.

Key Features:

- Albert Instant: $250 overdraft protection.

- Genius Team: Real financial experts will text you about personal advice.

- Smart Savings: This consists of saving you money automatically depending on your habits.

Pros:

- This is a luxury human feature

- Immediate access to cash

- Sleek app outline.

Cons:

- The basic Genius subscription (which is necessary to access most of the best features) is 14.99/month

- Auto-upgrade to paid level can be difficult to understand.

Pricing: Genius fee costs 14.99/mo; small fee of instant transfer.

Best For: Individuals that prefer personalized financial advice and guidance through text.

8. Varo

Varo is an online bank which is comparable to Chime. It offers a higher borrowing limit of $500 on its Varo Advance, compared to most apps. The price that Varo charges you upfront is the one that you will actually pay when you borrow, hence no surprises. It is professional and transparent as a bank, but less regulated. There are also high-interest savings accounts at Varo, which is why you can save your money in a safe place.

Key Features:

- Varo Advance: Borrow up to $ 500 (limits begin lower).

- No Any Other Charges: Simple, upfront charges on advances (e.g. charge $6 on a borrowed $100).

- Early Direct Deposit Early access to your paycheck: have your paycheck up to 2 days early.

Pros:

- Greater limit compared to the majority of simple applications

- Banking license is a guarantee of security

- High-interest savings account.

Cons:

- It will need a Varo banking account

- The fees are flat but may accumulate when used regularly

- It will require some time to qualify.

Pricing: Free account; charges between 1.60 and 40 on the basis of size of advance.

Best for: Individuals who would like a flat-fee system, which is transparent, to tipping.

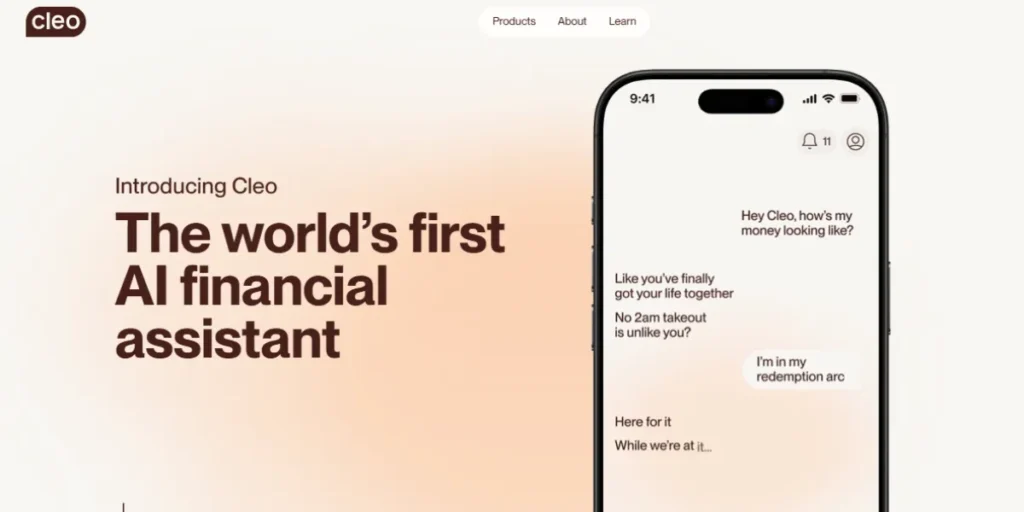

9. Cleo

Cleo is the flirtatious application of these services. A chatbot speaks to you in a brash best friend. Ache ye when thou waste on coffee and grains when thou save. It also loans out cash up to 250 dollars in the form of a loan known as a salary advance. The application is entertaining and is targeted to Gen Z and Millennials that find conventional banks boring. When you are in need of cash and a laugh, Cleo is your place. As one of the popular apps like Dave, it fits well among modern apps for borrowing money that offer quick and playful financial support.

Key Features:

- Roast Mode: The AI makes fun of your expenditure.

- Salary Advance: $250 or less with no credit background check.

- Credit Builder: Assists in developing a history of credit score.

Pros:

- This is a very entertaining user experience

- It is extremely easy to use

- It is very useful in motivation and budgeting awareness.

Cons:

- The roasting is not everyone

- You need to subscribe to advances and credit building (5.99/mo).

Pricing: Cleo Plus is free at entry level budgeting; $5.99/month is the price in the second tier.

Best For: The Gen Z users who desire an entertaining interactive approach to money management.

10. Payactiv

Payactiv is not like the majority of apps like dave since it typically has direct integration with your employer. When your boss is using Payactiv, you can receive up to half of everything you made immediately after work. This is nearly as if receiving payment on a daily basis. In case your company is not a partner, you can still use Payactiv but the rules are slightly different. It is highly convenient among the workers who require fast cash to buy gas or other day to day expenses.

Key Features:

- Earned Wage Access: Your payment immediately after work.

- Bill Pay: Pay bills with the money you earned using the app.

- Promotions: Prescription and gas savings.

Pros:

- cheapest when your employer pays it

- Quick cash

- Best with hourly employees.

Cons:

- Best features require employer support

- Appears more as a business application than a standard consumer application.

Pricing: Typically, free among employees; a charge of 1 dollar per day to users that are not members of a business plan (limit applies).

Best for: It should be used by employees whose companies provide this as a benefit.

11. FloatMe

FloatMe is made to be easy. It assists you in covering minor gaps between payday. First short advances of up to 20 to 50 dollars are available. It is not a bank; it will only make you pay less a $35 overdraft fee. The app is tiny, fast to install, and performs just a single task, which is to provide you with a small extra cash to enable you to pay off a little bit of money either on a meal or a gas tank without going into the red. As one of the simple apps like Dave and popular instant payout money apps, FloatMe focuses on providing quick, small advances without complicated banking requirements.

Key Features:

- Short-term cash advances of up to $50 (capable of increasing later).

- Overdraft Alerts: Real time warnings when your account is low.

- Smart Saves: Savings tools.

Pros:

- Small monthly fee

- Easy to receive a small advance.

Cons:

- Minimal limits (begin at 20-30)

- Not suitable for emergency situations.

Pricing: The subscription is priced at $3.99 a month; there is no fee on routine delivery.

Best for: Students or individuals that require not more than $20-50.

12. Possible Finance

Possible Finance is not a cash advance only. It is a temporary installment loan. It is targeted at individuals who have poor or no credit. In contrast to payday loans, Possible reports your payment details to credit bureaus, and you can establish credit. You may borrow up to 500 dollars and pay within several weeks where the four payments are in a duration of approximately eight weeks. In that manner you do not need to pay as a big lump sum.

Key Features:

- Credit Reporting: Makes the payment information to TransUnion and Experian.

- Installment Repayment: Ensure that the payment is made in four instalment (approximately eight weeks in total).

- High Acceptance: Approves using banking history and not credit score.

Pros:

- Instills credit score

- Repaying becomes easy

- Bad credit.

Cons:

- More costly than tip apps (prices vary depending on the state)

- It is a loan, not an easy payday.

Pricing: The charges vary depending on the state, and they tend to range between 15 and 20 per 100 dollars borrowed.

Best for : Individuals with poor credit who require a longer credit period.

13. Dailypay

DailyPay operates in a similar way as Payactiv. It is primarily an employer advantage. It allows employees to have control over the payment time. You get to know your balance as you work and you can transfer that money to a bank account immediately. It is used by numerous large retailing and fast-food chains. In case you are an employee of a large organization, check whether they have DailyPay and test it out first before using other applications. It is normally the most cost effective and secure method of acquiring funds.

Key Features:

- Balance: The earnings in the app keep changing, as you work every day.

- Savings Tool: Money can automatically be automatically transferred to a savings account.

- Any Account: Transfer the funds to any debit or bank account.

Pros:

- Direct entry into 100 percent of earned funds (after withholdings).

Cons:

- You cannot transfer instantly without the consent of your employer

- Transfers incur a fee.

Pricing: ATM-type fee of 2.99 dollars to do an instant transfer; transfer the following day is usually free.

14. Branch

Branch is an app that is a mobile bank designed to serve gig workers and hourly paid individuals one of the alternative apps like dave .It is a digital wallet: you can take pay, take it with a debit card, and obtain short-term cash advances. It is employed by many companies, yet gig workers will be able to receive payment more rapidly. Branch declares that there are no fees on the basic services. It has an uncomplicated orange layout that is simple to operate and targeted at the current employees.

Key Features:

- Instant Pay: Access up to half of earned wages.

- Fee-Free Banking: There are no overdraft fees; free use of Allpoint ATM.

- Cash Back: Get rewards when purchasing with a debit-card.

Pros:

- Ideal when you are a gig worker

- You can obtain a virtual card immediately

- No subscription.

Cons:

- Advance limit varies based on the presence of regular

- Direct deposits

- Customer services are slow.

Pricing: It is free to use with some charges in the event of sending money to other cards immediately.

Best for: Gig workers and contractors that desire a committed, business-like account.

15. Current

Current is a highly popular teen banking fintech apps like dave that also has an adult version, which is very useful in cash flow management. It has an Overdrive option that allows it to overdraft to the tune of 200 dollars without charge. The Current is fast-paced, as the application updates transactions immediately and accepts direct deposits within seconds. It also has savings pods, to keep rent money and fun money separate, and no need to get an advance.

Key Features:

- Overdrive: Get overdraft up to $200 fee-free.

- Points: Earn cash-back points at the stores of choice.

- Savings Pods: Get 4 percent interest on your savings.

Pros:

- Good interest on savings

- Fast application, good overdraft cover.

Cons:

- Your primary bank shall be Current and would need a direct deposit establishment

- Limits are initially low.

Pricing: Free overdrive.

Best For: Individuals that seek high savings interest and overdraft protection.

16. Grid Money

Grid Money assists you to make more out of your paycheck by changing the tax withholdings and then presents you with the cash advance based on the additional amount. It suits those individuals with large tax refunds that desire the cash sooner than later to pay expenses.

Key Features:

- Tax Optimization: Adjust the paycheck to boost the take-home pay.

- Cash Advances: Borrow during the time between paychecks.

- Debt Protection: Debt management tools.

Pros:

- Uniqueness in the way of generating income

- Corrects any tax mistakes

- Credit-building.

Cons:

- High cost of $10/month (compared to some other services

- More complicated than simple loans.

Pricing: $10/month membership.

Best for: Individuals who have substantial tax refunds and need more even annual income.

17. SoLo Funds

SoLo Funds is a community market whereby you borrow money not through a bank but through other people. Make a request, establish a date and provide a tip to the lender. Paying back well increases your SoLo Score increasing the ease at which you borrow money.

Key Features:

- Peer-to-Peer Lending: Not a bank, but real people.

- Community Focused: Social options and lending back.

- Flexible Terms: Select the tip and date of repayment (within constraints).

Pros:

- No strict AI

- It will create community trust

- Can be applied to non-traditional income.

Cons:

- There is no certainty of funding

- Large tips may prove expensive.

Pricing: Donation and tip to the lender is optional.

Best for: The users who prefer a community style or those who have been discriminated against by the algorithms.

18. One@Work (formerly Even)

One@Work is a financial planning app which connects to your bank, and displays your bills against money you can spend. It can also provide early wages access through its Instapay feature. The application is well-polished and plan-oriented.

Key Features:

- Instapay: Get paid the wages in advance (in many cases it is free with partner employers).

- Automatic Budgeting: Bills are spotted and automatically allocated.

- Savings Goals: Easy to save towards certain goals.

Pros:

- It is the best in the industry

- It is highly accurate in budgeting

- It is compatible with large employers.

Cons:

- Cost of membership in case it is not paid by your employer

- More of planning than instant money.

Pricing: Premium features cost about $6 -8 per month.

Best For: This should be used by those users who require assistance in managing their budget and at the same time have early cash.

19. Moneymax

MoneyMax is an all-in-one financial assistant app that helps users get instant cash advances, manage subscriptions, and track spending. It integrates budgeting tools and personalized recommendations to help optimize finances.

Key Features:

- Instant Cash Advance: Borrow up to $300 with no interest for short-term needs.

- Subscription Manager: Tracks recurring payments and warns of unnecessary charges.

- Smart Budgeting: Provides weekly and monthly spending insights.

Pros:

- Fast cash access with minimal hassle

- Comprehensive financial management tools

- User-friendly interface and notifications for overspending

Cons:

- Cash advance is limited to $300 initially

- Premium features require $9.99/month subscription

Pricing: Free basic version; Premium subscription at $9.99/month for advanced features

Best For: Users who want a combination of cash advance, subscription tracking, and budgeting assistance

20. Gerald

Gerald is modeled after the 2026 subscription economy. It advances you your rent, utilities and other bills. It also monitors your subscriptions and tells you whether you are paying more than you need. Gerald is interested in maintaining the vital services.

Key Features:

- Bill Advance: Bills covering.

- Subscription Tracker: Discovers undesired subscriptions to cancel.

- Rewards: Get coins to finish paying bills on time.

Pros:

- Niche focus is keeping your important things going

- It has an overdraft protection.

Pricing: $9.99/month membership.

Best For: Individuals that have difficulty making payments to bills on time.

Conclusion

You do not have to visit banks to borrow little money anymore because 2026 is close at hand. Applications such as Dave have developed and become a broad market where people can find numerous choices that can fit their financial lifestyle.

- MoneyLion or EarnIn is the best option in case you are in need of large loans.

- Chime or Varo should have no charges.

- Albert, Cleo or Empower will assist you with the budget.

- Possible Finance or Brigit will rebuild your credit in case you have bad credit.

FAQs

Do the apps influence my credit rating?

Generally no. The majority of apps do not verify your credit and record late payments.

What about the monetization of these apps like dave since they are free?

They make money out of optional tips, fast-cash fees, monthly upgrades or card fees.

Is it possible to work with many applications simultaneously?

Yes, but careful. The multiplication of apps can make you have a debt cycle of borrowing to pay back.

What is the time to receive the money?

Normal transfers are free and require 13 days to 3 days business. In case you really need one immediately, the majority of apps cost $0.99-$5.99 to get instant cash.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!