Zepto vs Blinkit: Complete 2026 Comparison

Quick commerce has also changed how Indians shop in their day-to-day necessities, and shopping that used to take hours will now be done in minutes. This revolution in retailing promises 10 to 15 minutes to deliver groceries, fresh produce, and household goods faster than a cup of tea. The rapid commerce sector in India has been booming as it had a small market of $300 million in 2022 and now a huge market of $7.1 billion in 2025, which is an unprecedented 24 times growth.

This industry is expected to reach $ 35 billion by 2030. This meteorical growth is enhanced by strategic networks of dark stores and mini warehouses located in residential areas that make it possible to fulfill orders within a short time. This convenience has been adopted by the urban consumers, especially in metropolitan cities, and quick commerce is now a part of the modern Indian way of life as opposed to a luxury service.

In this guide we will explore the “Zepto vs Blinkit” Comparion in depth.

Why Zepto and Blinkit Dominate the 10-15 Minute Delivery Space

- Massive Dark Store Networks: The two platforms have hundreds of strategically positioned micro-warehouses in key cities, and therefore, products can be received within minutes.

- Operations Technology: Sophisticated algorithms are used to optimize inventory management, routing and real-time tracking of orders to their optimal use.

- Good Financial Support: “Big round financings of billions of dollars allow aggressive growth and operation when it loses in the early years.

- First-Mover Advantage: They created brand recognition and customer loyalty before competitors entered the market through early entry into quick commerce.

- Strategic Positioning: They are the only e-commerce company that is focused on ultra-fast delivery, which makes them stand out of the other e-commerce giants such as Amazon and Flipkart.

- Metro City Focus: It is more profitable and service quality is maximized by concentrating resources in areas with high-density urban areas and large volumes of orders.

Company Overview

Zepto

Aadit Palicha and Kaivalya Vohra are 19-year-old friends who are the founders of Zepto, an Indian based company founded in 2021 by two ambitious Stanford University dropouts who saw a significant undeserving in the Indian delivery system during the COVID-19 lockdown. Starting with KiranaKart which collaborated with local outlets, soon shifted to a vertically integrated, dark store format meant to be operated solely on ultra-fast delivery. Their ten minutes delivery guarantee shook the market and formed a strong appeal to city dwellers.

Zepto became a unicorn in a mere two years at a valuation of over a billion dollars. As of 2024, the company had over $1.3 billion of funding, and it was valued at $5 billion, with the goal of going public in 2025. Zepto has been running in 35 cities and 550 dark stores, serving more than 700,000 orders daily and possesses the best rating (4.7/5) on all apps in comparison to quick commerce platforms.

You Might LIke: Zepto Franchise Cost in India

Blinkit

Blinkit was started in 2013 as Grofers by Albinder Dhindsa and Saurabh Kumar as a classic online grocery store, which serviced the intended monthly shopping habits. But in the wake of the changing consumer preference towards instant gratification, in 2021, Grofers radically changed its name to Blinkit and made a loud commitment to launch: delivery in the blink of an eye. It was not just a cosmetic overhaul but a full operation overhaul to compete in the new division of 10-minute delivery.

The disrupter came in 2022 when food delivery giant Zomato took over Blinkit in an all-stock transaction of $568 million. This led Blinkit to acquire the enormous logistics network and 100 million+ monthly active users of Zomato, which gave it an outrageous valuation of $13 billion, or even greater, than the actual food delivery business of Zomato.

You Might Like: Blinkit Franchise Cost in India

Zepto vs Blinkit | Key Differences

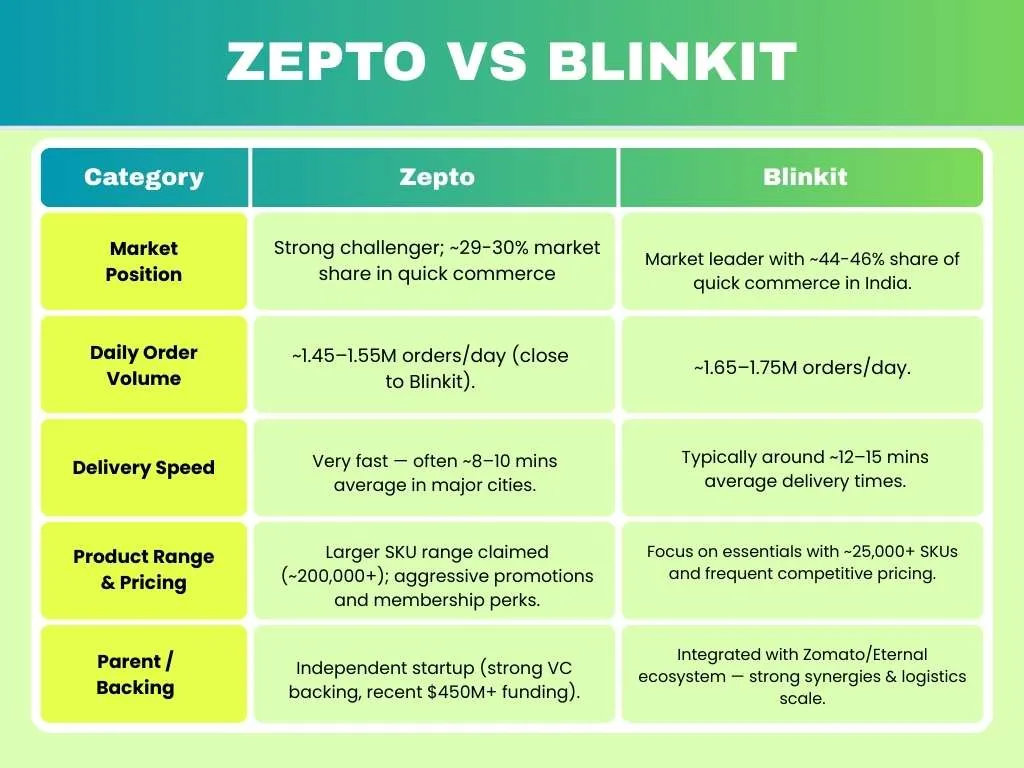

- Market Share: Blinkit controls with a market share of 45-46% and Zepto has a market share of 21-29% based on the source of reporting.

- Geographic Reach: Blinkit operates 30+ cities and has 700-2000 dark stores; Zepto operates 10-35 major cities and has 550+ stores.

- Valuation: Blinkit net worth $13 billion dollars (part of Zomato); Zepto $5-7 as a standalone company.

- Parent Company Support: Blinkit takes advantage of 56% level of market share of food delivery by Zomato and cross platform integration; Zepto is independent.

- Delivery Time: Zepto takes an average of 8-10 minutes; Blinkit takes an average of 10-20 minutes but it is more reliable during the peak hours.

- Product Range: Blinkit has more general categories; electronics and gifts, Zepto more so with the recent Zepto Cafe expansion.

- App Experience: Zepto has a minimalist design (4.7 rating), whereas Blinkit has solid features and product details (4.6 rating).

- Expansion Strategy: Zepto adheres to the model of density-first dominating metros; Blinkit employs strategic penetration in the wide range of variety in the urban markets.

Zepto vs Blinkit | Pricing Comparison: Which Is Cheaper?

| Item | Zepto Price | Blinkit Price | Winner |

| Milk (1L) | ₹58-62 | ₹58-60 | Similar |

| Bread (Standard) | ₹30-35 | ₹30-35 | Similar |

| Rice (5kg) | ₹285-300 | ₹280-295 | Blinkit |

| Onions (1kg) | ₹35-40 | ₹35-42 | Similar |

| Whole Wheat Flour (5kg) | ₹308 | ₹287 | Blinkit |

| Fresh Vegetables | ₹40-80/kg | ₹38-75/kg | Blinkit |

| Personal Care Items | ₹150-500 | ₹145-480 | Blinkit |

| Delivery Fee | ₹0 (₹199+ orders) | ₹15-35 (waived above threshold) | Zepto |

Verdict: Blinkit is a little cheaper on single purchases having regular discounts and vouchers. Zepto offers more competitive prices in bulk orders with Super Saver at ₹499+ and above. The difference is not significant, only ₹5-15 in average on average grocery baskets, and both sites are very competitive.

Zepto vs Blinkit | Financial Performance & Market Share

Revenue, Expenses, and Net Loss Comparison

| Feature / Metric | Zepto | Blinkit |

|---|---|---|

| Revenue (FY) | ₹2,024 crore in FY23 (14× FY22) | ₹2,301 crore in FY24 |

| Quarterly Revenue | Not specified | ₹1,709 crore in Q4 FY25 (122% YoY growth) |

| Losses | ₹1,272 crore | Not specified |

| EBITDA / Profitability | Near-EBITDA positive; 140% YoY growth | Adjusted EBITDA positive since March 2024; contribution margin positive per transaction |

| Annual GMV / GOV | >$1.5 billion | Q4 FY25 GOV ₹9,421 crore (134% YoY growth) |

| Store Profitability | New stores profitable within 6 months (vs 23 months previously); ~75% dark stores profitable as of May 2024 | Not specified |

| Operational Efficiency | Improved store profitability speed; better operational efficiency | Zomato reports contribution margin positive on every transaction; Goldman Sachs forecasts 53% CAGR of GOV (2024–2027) |

| Growth Indicators | Faster profitability of stores; strong GMV growth | Strong quarterly revenue growth; GOV growth; future CAGR forecast |

Market Share and Number of Stores

| Feature / Metric | Zepto | Blinkit |

|---|---|---|

| Market Share (Quick Commerce) | 21–29% | 45–46% |

| Competitor Market Share | Swiggy Instamart: 25–27% | Zepto: 21–29% |

| Number of Dark Stores | 550+ currently; 700 planned by March 2025 | 791–2,000 across 30+ cities |

| Geographical Focus | 35 large metros; depth-focus strategy | Expansion into smaller Tier-2 cities and metros |

| Expansion Strategy | Gradual store rollout with operational efficiency | Aggressive expansion and market consolidation in multiple cities |

Funding History and Valuation

| Feature / Metric | Zepto | Blinkit |

|---|---|---|

| Total Funding Raised | $2.3 billion across 14 rounds | $757 million across 15 rounds (pre-acquisition by Zomato) |

| Major Recent Rounds | Series F: $665M (3.6B valuation), Series G: $340M (5B valuation), Series H: $350M | N/A (pre-acquisition rounds) |

| Acquisition / IPO | IPO expected in 2025; recent news valuation ~$7B | Acquired by Zomato in 2022 for $568M; post-acquisition valuation ~$13B |

| Notable Investors | General Catalyst, Glade Brook Capital, DST Global, Nexus Venture Partners, Y Combinator | SoftBank Vision Fund, Tiger Global Management, Peak XV Partners; Zomato infusion ₹1,500 crore (Feb 2025) |

| Valuation Growth | $3.6B → $5B → $7B potential | 6× growth since March 2023; post-acquisition valuation $13B |

| Funding Purpose / Notes | Scaling operations, store expansion, operational efficiency | Expansion post-acquisition, accelerating growth under Zomato |

Insights into Profitability Strategies

Both Zepto vs Blinkit are no longer pursuing growth at any costs models but profit-oriented models. By April 2024, Zepto had increased commissions (10-25% based on category) and made unit economics negative (less than 8 per order) to negative ₹0.5. Blinkit has applied dynamic commission models based on selling prices, attained contribution margin positivity and uses the existing infrastructure of Zomato to lower the cost of running operations and increase their category of high-margin products such as electronics and premium products.

Delivery Partner Insights: Zepto vs Blinkit Salary

- According to Order Earnings: Delivery partners get ₹15-50 based on distance (1-5km) and platform policies: Blinkit initially charged ₹50 per order but then dropped to ₹15-25, whereas Zepto currently charges ₹30-100 based on distance.

- Daily Revenue Potential: Partners doing 20-30 orders each day can get a ₹600-1,200/day; high in metro cities say they are getting up to ₹2,200/day with incentives.

- Monthly Earnings Range: Monthly income is fluctuating between ₹15,000-60,000/year (₹1.5-4.5 lakh) with full time partners at ₹25,000-35,000 in the metros after deductions.

- Incentive Structure: Base earnings are supplemented by incentive bonuses like Peak hour bonuses ( ₹75-125 in case of target deliveries), weekly performance bonuses and surge pricing (during high demand times).

- Benefits: medical insurance covering up to ₹1-10 lakhs, accident insurance, joining bonuses up to ₹4,000, and some places have free meals and transport facilities.

- Issues encountered: Partners incur fuel expenses (₹300-400 per day), car maintenance fees, lack of assured salary, health risks due to traffic/pollution, unforeseen changes in policy that cut per-order earnings, and demands to deliver extreme fast speeds.

- Work Flexibility: Partners select their shifts (fulltime, part-time or weekend-only) but longer working hours (10-14 hours per day) are required to reach the advertised monthly earning potential.

Revenue Model: How Zepto & Blinkit Make Money

- Supplier Commissions: Suppliers and brands are charged 10-25% commission per order based on the product category- groceries (10-15%), FMCG (15-20%), electronics and premium goods (20-25%). Recently, Blinkit shifted to selling price-based dynamic commission models to enhance flexibility.

- Delivery Charges: Blinkit charges ₹15-35 per order (free above minimum cart value); Zepto will deliver free on orders over ₹199. Surge pricing provides extra revenue during peak hours or high demand seasons as they control the number of orders.

- Advertisement and Brand Promotions: FMCG brands have sponsored listings, banners, and priority product positioning in apps at premium prices. This source of advertising revenue has gained momentum as the two platforms continue to expand their user base.

- Marketplace Fees: the fees imposed on the sellers by dark store platform, inventory management software, and logistics networks. These charges fund operations and offer the sellers access to vast distribution networks.

- Premium Subscriptions: Zepto provides Zepto Pass, free delivery, and exclusive discounts; Blinkit is compatible with Zomato Gold Loyalty Program where it offers cross-platform benefits. The subscription revenue offers consistent recurring revenue and customer retention.

- High-Margin Categories: An expansion to electronics, gifting, personal care, and prepared food (Zepto Cafe) results in gross margins of 30-50% as opposed to basic groceries of 10-15%. These high-end segments greatly enhance the unit economics and profitability ratios.

Zepto vs Blinkit | Which App Is Better? Expert Insights

The decision of Zepto vs Blinkit is all a matter of your priorities and location. To ensure fastest speeds in big cities, Zepto always performs under 10 minutes with its bare-bones app experience and the highest user scores. But should you care about product mix, competitive prices and uniform service available in different cities including Tier-2 towns, the widespread 30+ city network and the wider product range of groceries to electronics makes Blinkit more adaptable. Blinkit also enjoys Zomato integration, which makes it easy to switch between food delivery and grocery shopping.

According to industry observers, the market dominance of Blinkit (45% share) and the valuation of $13 billion of the Goldman Sachs are indicative of better long-term sustainability supported by the infrastructure of Zomato. In the meantime, fast innovation, autonomous functioning, and metro conquest of Zepto will be attractive to users who value advanced service. Finally, the two platforms have strikingly close prices, with only ₹5-15 difference on average orders, so you need to focus on delivery speed, availability of products within your location, and the experience of using the app. Smart consumers frequently combine both apps, reviewing real-time delivery estimates and price and using a discounted gift card to get the most savings.

Challenges Faced by Zepto & Blinkit

- Profitability Pressure: Both companies are still spending a lot of cash through operations losses in excess of ₹1,000 crore in a year; sustainable profitability is not assured even with a positive contribution margin.

- High Competition: With aggressive growth by Swiggy Instamart, new offerings Flipkart Minutes and Amazon Fresh, and BigBasket on a rapid move towards the quick commerce pivot, market share and margins are under sustained threat.

- Delivery Partner Welfare: Increasing employee complaints about lower per-order pay, ineligibility of employment benefits, high fuel prices, and exploitation are disrupting business continuity and reputation.

- Regulatory Introspection: Retail associations in India want the antitrust investigations of predatory pricing, unfair competition with local kirana stores, and monopolistic tendencies that might cause regulatory sanctions.

- Operational Complexity: It takes advanced logistics and technology to coordinate perishable inventory in hundreds of dark stores, delivery speed in peak time, stockouts and minimal waste.

- Expansion Sustainability: Remains to be seen whether the quick commerce model that is relied upon in high-density metros can be transferred to Tier-2/3 cities where order volumes are lower and consumer behavior is different.

- Labor Rights Issues: Delivery partners should be considered employees, not gig workers, to be given statutory benefits; Zomato (parent of Blinkit) was rated by the Fair Work India at 4/10 when it came to working conditions, which raises ethical concerns.

Conclusion

The Zepto vs Blinkit rivalry is not only a matter of two fast-commerce giants competing with each other, but it is also a marker of the radical shift in Indian retail. Both platforms have managed to make 10-minute delivery a consumer norm and not a luxury, and process millions of orders per day, and redefine the way urban India shops. The market leadership of Blinki,t supported by the ecosystem of Zomato, the valuation of $13 billion created by Goldman Sachs, and lucrative unit economics, is proven to be sustainable. The characteristics of disruptive innovation and investor trust can be observed in Zepto, which has already been valued at $5-7 billion in only three years and has plans to have an IPO in 2025.

To consumers, this competition intensity is translated to improved service, broadening of products, and low costs even given high-end convenience. With the rapid growth of the commerce market in India, approaching the 35 billion mark by 2030, both Zepto and Blinkit will continue to adapt, evolve, and shape the future of instant retail. With or without Zepto, with its focus on speed, or Blinki,t with its open-ended versatility, consumers still are the ultimate beneficiaries as this continued fight has brought the level of convenience in Indian business irrevocably higher.

FAQs

Which is faster: Zepto or Blinkit?

Zepto is generally faster with an average delivery time of 8-10 minutes in metro cities, whereas Blinkit has a longer average of 10-20 minutes but is more regular within peak time.

What is the cheaper site for groceries?

Blinkit offers slightly lower prices on individual items with regular discounts, while Zepto offers higher discounts on bulk orders. The overall price differences are also very low, ranging from ₹5 to ₹ 15 in a regular grocery basket.

What is the market share of Zepto vs Blinkit?

Blinkit holds the largest market share at 45-46%, with Swiggy Instamart (25-27%) and Zepto (21-29%) trailing. These are the leading players in the Indian quick commerce market.

What is the income of Zepto and Blinkit delivery partners?

Delivery partners receive ₹15-₹50 per order, and monthly revenue ranges from ₹15,000-₹- ₹ 60,000, depending on work hours, orders delivered, and location. Metro city full-time partners are an average of ₹25,000-35,000 per month.

Are Zepto and Blinkit profitable?

Both platform are not completely profitable. Blinkit reached EBITDA positivity in March 2024, and Zepto reports almost EBITDA positivity, with 75% of stores profitable. Both have continued to invest heavily in expansion despite improving unit economics.

Get 50% off on Vault theme. Limited time offer!

Get 50% off on Vault theme. Limited time offer!